UTI Asset Management Company (UTI AMC) has filed draft prospectus with SEBI, seeking regulatory nod for launching its IPO. According to the DRHP, UTI AMC IPO will involve sale of 38,987,081 shares. The IPO is likely to mobilize around INR3,800 crore, valuing the company at around INR12,000 crore. The company counts global mutual fund giant T Rowe Price as its largest shareholder which invested in November 2009. Here are some quick facts to know about the UTI AMC and its upcoming IPO:

UTI AMC: Business Background

UTI AMC is the seventh largest asset management company in India in terms of mutual fund QAAUM (Quarterly Average Assets Under Management) as of 30 September 2019. It claims to have the largest share of monthly average AUM attributable to B30 cities (beyond top 30 cities) of the top 10 Indian asset management companies by QAAUM. The company manages the domestic mutual funds of UTI Mutual Fund and manages 178 mutual fund schemes, comprising equity, hybrid, income, liquid and money market funds as of September 2019.

Read Also: All about shareholders’ reservation works in IPOs

As of 30 September 2019, UTI AMC’s total QAAUM for domestic mutual funds was INR1,542.3 billion, while Other AUM was INR6,254.7 billion. With 11 million live folios as of 30 September 2019, the company’s client base accounts for 12.8% of the approximately 86 million folios managed by the Indian mutual fund industry. The management fees in respect of its domestic mutual funds accounted for 72.7% of its total income for the six-month period ended 30 September 2019.

Read Also: Biocon Biologics IPO in works, Kiran Mazumdar-Shaw hints

UTI AMC IPO: Beyond Mutual Funds

Apart from mutual funds, UTI AMC provides portfolio management services (PMS) to institutional clients and high net worth individuals (HNIs), and manages retirement funds, offshore funds and alternative investment funds.

Under the PMS business, it provides portfolio management services to institutional clients and HNIs. It offers discretionary PMS to the Employees’ Provident Fund Organization (EPFO), the National Skill Development Fund (NSDF) and to HNIs, Non-Discretionary PMS to Postal Life Insurance (PLI), and Advisory PMS to various offshore and domestic accounts. Following the most recent mandate awarded by the EPFO on 9 September 2019, UTI AMC now manages 55% of the total corpus of the Central Board of Trustees, EPF (CBT, EPF).

UTI AMC IPO: Wide distribution network

UTI AMC has a nationwide footprint and offers schemes through a diverse range of distribution channels. As of 30 September 2019, its distribution network includes 163 UTI Financial Centres (UFCs), 273 Business Development Associates (BDAs) an Chief Agents (CAs) (46 of whom operate Official Points of Acceptance (OPAs)) and 33 other OPAs, most of which are in each case located in B30 cities. Its Independent Financial Advisors (IFA) channel includes approximately 51,000 IFAs as of 30 September 2019.

This distribution network is supported by 486 relationship managers (RMs) who interact with clients and distributors and help generate new business and maintain existing relationships. The company also has offices in London, Dubai, Guernsey and Singapore, through which it markets its offshore and domestic mutual funds to offshore investors.

UTI AMC: Capital structure

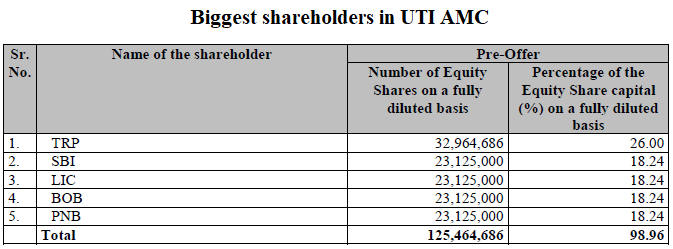

As mentioned above, T Rowe Price is the biggest shareholder in the company with 26% equity stake. State Bank of India (SBI), Life Insurance Corporation (LIC), Punjab National Bank (PNB) and Bank of Baroda (BOB) each hold 18.24% percent stake in the UTI AMC.

UTI AMC IPO: All OFS

All the shares offered in the IPO will be sold by existing shareholders through Offer for Sale (OFS) mechanism. As such, the company will not get any funds from the IPO. Of the 38,987,081 shares to be sold through the IPO, 10,459,949 shares will be sold by SBI, LIC and BOB while PNB and T Rowe Price will each offload 38,03,617 shares.

The share sale is mandated by SEBI which has set an upper limit of 10% on cross-holding. This means that all four of the Indian shareholders in UTI AMC are in conflict as each of them has in-house mutual funds.

UTI AMC IPO: No shareholder reservation

Contrary to expectations on social media, there will not be any reservation in UTI AMC IPO for shareholders of SBI, BOB or PNB.

However, there is a reservation of 200,000 shares in the IPO for eligible employees.

UTI AMC: IPO Pricing

The company has only filed draft prospectus as of now and thus, there is no word on pricing. However, going by the initial estimates of IPO size being INR3,800 crore, it is expected that the shares might be priced in the range of INR900 -1,000.

UTI AMC IPO: Financial Performance

UTI AMC has maintained healthy margins in the last three years. However, the same cannot be said about the revenue growth.

UTI AMC’s financial performance (in INR crore)

| FY2017 | FY2018 | FY2019 | Q1 FY2020 | |

| Revenue | 1,048.6 | 1,162.7 | 1,080.9 | 496.4 |

| Expenses | 527.7 | 617.3 | 589.6 | 257.1 |

| Net income | 395.2 | 404.6 | 311.1 | 186.9 |

| Net margin (%) | 37.7 | 34.8 | 28.8 | 37.7 |

How to apply for ipo allotment