The Nifty 500 stock list tracks the performance of the top 500 blue-chip companies on the National Stock Exchange (NSE) based on market capitalization. The Nifty 500 is an Indian benchmark index. It represents the weighted average of the top 500 NSE-listed companies.

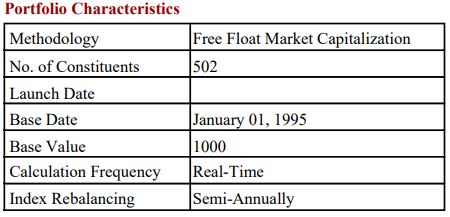

Nifty 500 Index is computed using the free float market capitalization method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to the particular base period. Nifty 500 can be used for a variety of purposes such as benchmarking fund portfolios, and launching index funds, ETFs, and structured products.

Table of Contents

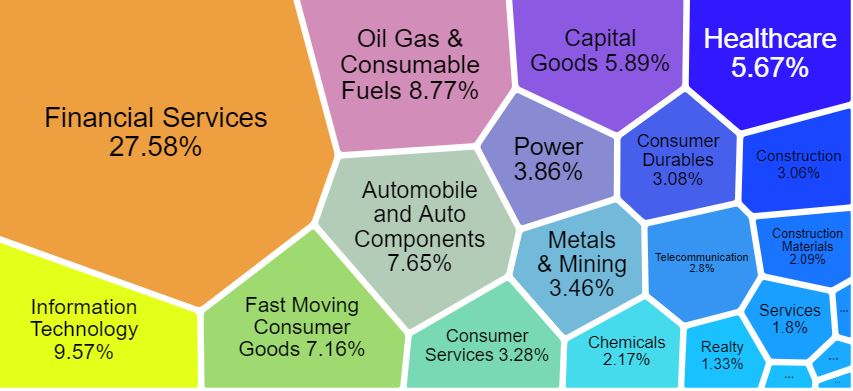

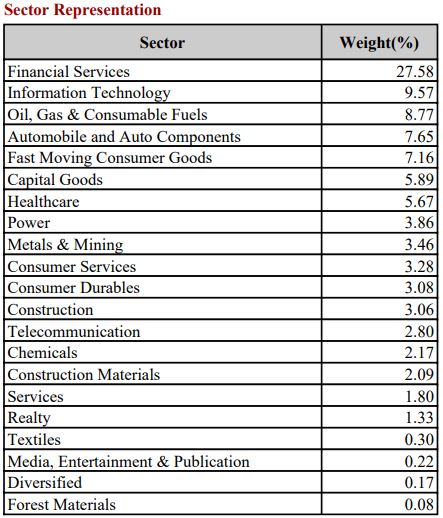

Nifty 500 Sector Weightage

The NIFTY 500 Index gives a weightage of 27.58% to Financial Services, 9.57% to IT, 8.77% to Energy, 7.65% to Automobiles, 7.16% to Consumer Goods, and 5.89% to Capital Goods. The NIFTY 500 index is a free-float market capitalization index. It is important to highlight that the Nifty 500 weightage of sectors keeps changing according to the performance of constituent stocks.

Read Also: Nifty PE Ratio – Most Important Points You Need to Know

Read Also: Highest IPO Subscription

Read Also: CDSL vs NSDL – Decoding India’s Two Depositories

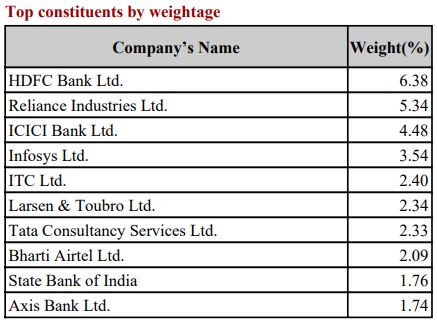

Nifty 500 Companies Weightage: 2024

The Nifty 500 stock list top 10 stocks consisted of the following

Nifty 500 Stock List 2024: Nifty Stock Weightage 2024

Just like its widely popular counterpart Nifty 50, the Nifty 500 index is dominated by stocks from financial services and IT services industries. The nifty 500 weightage of a stock is directly proportional to its market cap.

Top Nifty 500 Companies List 2024: Selection Criteria

All equity shares listed on the NSE are eligible for inclusion in the Nifty indices. Convertible stock, bonds, warrants, rights, and preferred stock that provides a guaranteed fixed return are not eligible for inclusion in the Nifty indices.

Companies must form part of the eligible universe to be considered for inclusion in the Nifty 500 index. The eligible universe includes: The companies ranked within the top 800 based on average daily turnover and average daily full market capitalization based on the previous six months’ period data.

Read Also: Investing in US Stocks Through NSE IFSC

Nifty 500 Stocks: Float-Adjusted Market Capitalization

Their free-float market capitalization determines the NSE 500 list of companies. Nifty 500 stocks’ free-float market cap is calculated by multiplying its stock price by the total number of shares available in the market. For example, if a company has 20,000 shares in free float and the price of each is INR 100, the company’s free-float market cap is INR 20 lakh (20,000 * 100). Companies will be eligible for inclusion in the NIFTY 500 stocks index provided the average free-float market capitalization is at least 1.5 times the average free-float market capitalization of the smallest constituent in the index.

Read Also: Best IPOs in 2024

Nifty 500 Stocks: Trading Frequency

The companies traded for at least 90% of days during the previous six-month period.

Nifty 500 Companies List 2024: Securities

Securities will be included if rank based on full market capitalization is among the top 350.

Securities will be excluded if the rank based on full market capitalization falls below 800.

Read Also: Nifty Auto Index – Full list of constituents and their weightages

Nifty 500 Stocks: Newly-listed Stock

The Nifty 500 company’s newly listed security is checked based on the data for three months instead of six months. If a company files for an IPO, it will be eligible for inclusion in the index if it meets the normal eligibility criteria for the index for 3 months rather than 6 months. This relaxation is only for IPO listing and the listing history remains 6 months for other listing options such as demergers and takeovers.

Happy Investing!

Read Also: Difference Between FDI and FII Explained in 10 Points

Nifty 500 Index Frequently Asked Questions

How many stocks are in the Nifty 500 Index?

Nifty 500 index comprises 500 stocks selected based on their free-float market capitalization.

Which sector has the maximum weightage in the Nifty 500?

With a weightage of 27.58%, Financial Services is the leading sector in the Nifty 500 index. IT (9.57%), and Energy (8.77%) are the next dominant sectors in the Nifty 500 companies list for 2024.

How often is the Nifty 500 rebalanced?

The index is re-balanced on a semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For a semi-annual review of indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to the market from the change date.

How soon can an IPO stock enter the Nifty 500 companies list in 2024?

Although the index requires a minimum listing history of 6 months, this criterion can be relaxed to 3 months for recently listed stocks through IPO, provided all other requirements are met.