Staffing firm TeamLease Services has revealed the pricing of its upcoming IPO which is scheduled to start on 2 February. The Bangalore-based company will offer the shares in the range of INR785—850 per share in the offer that will be a mix of fresh issue and an offer for sale (OFS) by existing shareholders.

TeamLease IPO aims to generate INR150 crore from the sale of new shares while private equity investors including Gaja Capital and India Advantage Fund plan to sell 32.19 lakh shares. Important among the selling shareholders are India Advantage Fund (15.33 lakh shares), GPE (India) (11.8 lakh shares), Gaja Capital India Fund (2.75 lakh shares), and HR Offshoring Ventures (1.53 lakh shares). The IPO will also have reservation of 10,000 shares for employees. On the upper end of the price band, the IPO will raise INR423.6 crore from investors while the proceeds will be INR402.7 crore on the lower side.

The company filed draft prospectus in September and received SEBI approval to bring the IPO last month.

Use of funds

The company will receive INR150 crore from the issue of new shares and a majority of these proceeds will be used for funding existing and incremental working capital requirements, acquisitions and other strategic initiatives, and upgradation of the existing IT infrastructure.

Business background

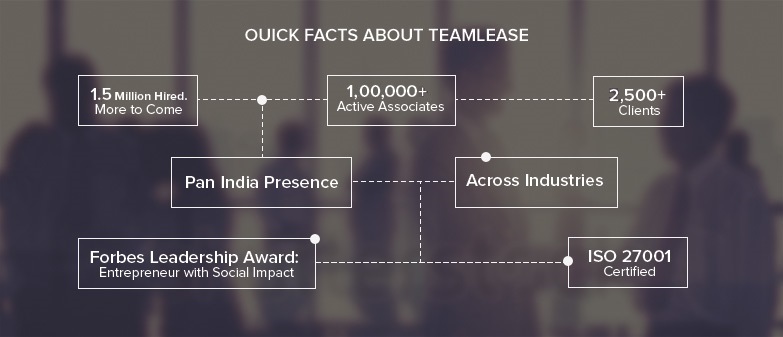

Manish Sabharwal-promoted TeamLease started as a temporary staffing player but has diversified into permanent recruitment, payroll processing, and learning services in recent years. The company claims to have placed 15 lakh employees to more than 2,500 clients across the country in its history. Started in 2002, the company has grown its network to eight regional offices and 1,200 employees now. Although it has roots in temporary staffing which continues to a big revenue driver, TeamLease has diversified into permanent recruitment, payroll processing, and learning services in recent years.

Interestingly, TeamLease’s competitor Bangalore-based Quess Corporation is also working to launch INR700 crore IPO. Quess’ board has approved the IPO plan, although the company is yet to file paperwork with SEBI.

Read Also: Quess Corporation hires banks for INR700 crore IPO

Financial performance

As one of the focused plays, TeamLease IPO is an important offer for investors. According to the red herring prospectus, TeamLease registered a profit of INR29.7 crore on total revenue of INR2,018.5 crore in the financial year ended 31 March 2015. This is worth highlighting that the staffing company’s financial performance increased steadily in each of the previous four years. The staffing company has impressed us with a consistent profitability record and going by the experiences of last year, it looks a winner. Although the valuation appears to be on the higher side based on historical performance, the company has demonstrated exceptional operational excellence in recent years. We will review the IPO in coming days to gain an in-depth understanding of the operations and future prospects.