Bangalore-based staffing firm TeamLease Services is scheduled to steal a march over its competitors by bringing its IPO on 2 February. The upcoming IPO will involve sale of shares in the range of INR785—850 apiece. On the upper end of the price band, TeamLease IPO will raise INR423.6 crore from investors while the proceeds will be INR402.7 crore on the lower side. Investors can subscribe to the issue through the ASBA process for a minimum of 15 shares and in the multiples thereafter.

The IPO will also have reservation of 10,000 shares for employees. TeamLease IPO has been assigned a grade of ‘4/5’ by CRISIL which indicates that the fundamentals of the IPO are above average relative to other listed equity securities in India. In this IPO review, we will see what makes TeamLease’s fundamentals strong.

In its red herring prospectus (RHP) filed with SEBI, TeamLease said the IPO will be a mix of fresh issue and an offer for sale (OFS) by existing shareholders. TeamLease aims to receive INR150 crore from the sale of new shares while private equity investors including Gaja Capital and India Advantage Fund plan to sell 32.19 lakh shares.

Issue details

| IPO dates | 2-4 February 2016 |

| Price Band | INR785-850 per share |

| Issue Size | INR402.7 – 423.6 crore |

| Offer for Sale | 32,19,733 shares |

| Minimum Bid | 15 shares |

| Retail portion | 10% |

Use of funds in TeamLease IPO

As mentioned above, TeamLease IPO will yield INR150 crore to the company. A majority of these proceeds will be used for funding existing and incremental working capital requirements, acquisitions and other strategic initiatives, and upgradation of the existing IT infrastructure. Out of the total, INR80 crore will be invested towards funding existing and incremental working capital requirements. According to the red herring prospectus filed with SEBI, the company will use INR25 crore towards mergers and acquisitions while INR15 crore have been earmarked for upgrading its existing IT infrastructure and proprietary technology platforms. These funds will be spent over a period of three years.

Selling shareholders

Important among the selling shareholders are ICICI Venture’s India Advantage Fund (15.33 lakh shares), GPE (India) (11.8 lakh shares), Gaja Capital India Fund (2.75 lakh shares), and HR Offshoring Ventures (1.53 lakh shares). HR Offshoring Ventures is the corporate promoter and holds 64.34 lakh shares or 41.97% of the pre-offer capital of TeamLease. India Advantage Fund currently holds 25.55 lakh shares (16.67% of pre-issue capital) while GPE India owns 29.51 lakh shares (19.25% of pre-issue capital). Manish Sabharwal’s HR Offshoring Ventures is among sellers but promoters will continue to own approximately 50.99% in the company even after the completion of TeamLease IPO.

Business background

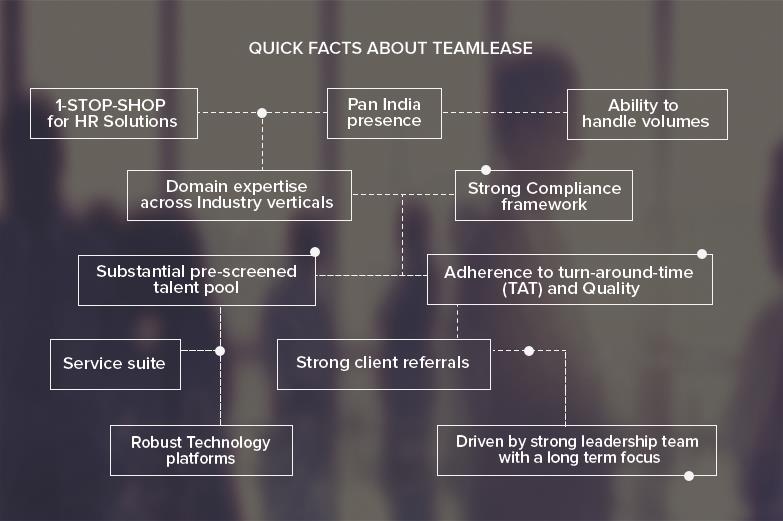

TeamLease is an established player in the Indian staffing market and claims to be the biggest player in the domain. Apart from staffing, TeamLease also operates corporate and institutional training business under IIJT brand. Permanent recruitment services and regulatory consultancy are some other businesses the company is involved into. However, TeamLease is out and out a staffing player with nearly 97.75% of revenues generated in FY15 contributed by the business. The rest including permanent recruitment, consulting, retail learning solutions etc contributed the remaining.

As of November 2015, TeamLease served 1,252 clients through a network of nine offices and 1,218 full-time employees across India. TeamLease also had 104,946 Associate Employees. At nearly INR18,000 crore annually, the flexi-staffing industry is already quite big but is expected to grow further. According to a CRISIL report, the industry will grow in the range of 20-25% between FY14 and FY19.

Consolidation is the name of game

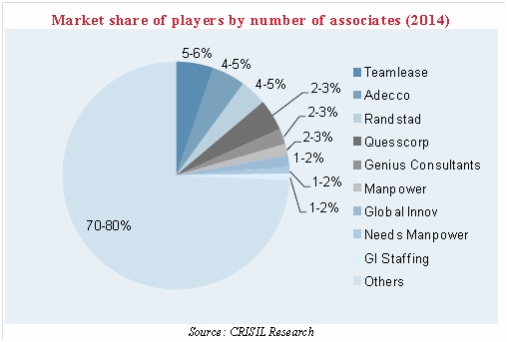

With its 5% share in the India staffing market, TeamLease claims to be the biggest player on the basis of number of associates. This is possible because the staffing market is highly fragmented. The accompanying chart illustrates that top five players controlled a combined market share of only 22% in 2014. A parallel to this rule can be seen in TeamLease’s top clients which includes names such as Godrej Industries and PNB Housing Finance. For the financial year ended March 2015, TeamLease derived 17.64% of its revenues from top five clients while the contribution of 10 biggest clients accounted for 24.56% of its total revenues. This is a fairly diverse client concentration and we like it.

Since the industry is highly fragmented, consolidation is the norm of the day. Big players were always involved into acquiring their smaller peers but the trend has strengthened in recent years. Randstad, Manpower, and Adecco – three of the biggest players in staffing business have done a total of 37 acquisitions since 2001. TeamLease is lagging behind in this aspect and except a few acquisitions; it has largely grown through organic channel. Nevertheless, the revenue growth is quite impressive and we can’t ask for more.

Serious money in staffing

We may not think of temporary staff in the most glorious terms but TeamLease has demonstrated there is serious money to be made here. There is a great management team, led by Manish Sabharwal, at the helm that has tripled revenues in four years. From a loss of INR39.5 crore in FY2011 to a profit of INR29.7 crore in FY2015, this is great execution in an environment where there is no room for complacency.

| TeamLease Services’ consolidated financials (in INR million) | |||||

| FY11 | FY12 | FY13 | FY14 | FY15 | |

| Total income | 6,983.2 | 9,340.9 | 12,616.9 | 15,375.2 | 20,184.6 |

| Profit/(loss) before tax | -378.1 | -165.5 | -42.7 | 177.7 | 325.9 |

| Profit/(loss) after tax | -394.9 | -165 | -37 | 178.6 | 296.9 |

| Margin (%) | -5.7 | -1.8 | -0.3 | 1.2 | 1.5 |

However, margins are slim at just 1.5% in FY2015 which was the best performance of the company in the last five years. These low margins can be easily offset by higher costs and the financial performance in the latest six months is a good example of this. Net margin of the company deteriorated to just 0.9% in the latest six months as employee benefit expenses zoomed 28.9% during the period.

Low margins and high valuations – A perfect recipe for disaster

Our regular readers know our reservation against low margin businesses but the real question investors should be asking is if they want to own a business that works on a 1% net profit margin. Staffing is a very competitive business because of low entry barriers. As new entrants keep coming in, even large players don’t enjoy pricing power. As a result, there is little scope of expanding margins unless the company moves away from staffing or undertake painful restructuring of its operations. In its prospectus, TeamLease acknowledges this by stating that most of its contracts are for a period of one year or less. Something to highlight here is that TeamLease has a high degree of loyalty among its clients. As much as 95.8% and 93.2% of its annual revenue in FY14 and FY15 come from repeat customers. Clients who are not billed for the first time during the relevant year are defined as repeat customers.

Margins of TeamLease are on the lower side when compared to its closest competitor Quess Corporation (formerly IKYA) which earned 2.7% margin in the 15 months ended 31 March 2015. Now, one can argue that Quess Corporations’ results indicate upside opportunity for TeamLease but let’s not forget that Quess is an integrated player and also operates in higher margin businesses such as facility management and training and skill development. Quite interestingly, Quess Corporation is also an IPO candidate and may bring its offer in coming months.

Despite CRISIL’s positive rating for the IPO, we find the issue is quite expensive. Considering the company’s diluted EPS (earnings per share) of INR19.32 in FY2015, TeamLease is asking for a P/E ratio of 40.6 on the lower side of price band while the valuation rises to nearly 44 times on the upper band. As there are no listed peers of TeamLease, these figures are not comparable to a yardstick but it doesn’t take long to understand that these are super rich valuations and puts the likes of Narayana Hrudayalaya to shame. More so in a low margin business like staffing. Without a doubt, Sabharwal & Co. needs to be given credit for putting together this excellent business but the asking price is simply too high. We absolutely adore the way the company is run by the management and there are no traces of mis-governance like several others but in our analysis, low margins and high valuations may prove to be a deadly combination for retail investors in TeamLease IPO.