Akme Fintrade IPO Description – Akme Fintrade is a non-banking finance company registered with the Reserve Bank of India as Non systemically important non-deposit-taking company having more than two decades of experience in lending business in the rural and semi-urban geographies in India.

Its portfolio includes Vehicle Finance and Business Finance Products for small business owners. The company currently extends its reach across rural and semi-urban areas in four Indian states: Rajasthan, Maharashtra, Madhya Pradesh, and Gujarat. Its registered office is in Udaipur, Rajasthan, with a corporate office situated in Mumbai. With 12 branches and over 25 points of presence, both digital and physical, the company has successfully served more than 200,000 customers.

As of 31 December 2023, its total credit exposure is INR 379.46 crore out of which INR 300.67 crore is of SME/ business loan which is 79.23% of total credit exposure. As of 31 December 2023, the company has approximately 32,771 outstanding loans under Vehicle Finance and Secured Business Loans/MSMEs. These loans support small enterprises and self-employed non-professionals, aiding their stores, retail outlets, handicraft manufacturing, and various other businesses.

Promoters of Akme Fintrade (India) – Nirmal Kumar Jain, Manju Devi Jain, Dipesh Jain, and Nirmal Kumar Jain HUF

Table of Contents

Akme Fintrade (India) IPO Details

| Akme Fintrade IPO Dates | 19 – 21 June 2024 |

| Akme Fintrade Issue Price | INR 114 – 120 per share |

| Fresh issue | 1,10,00,000 shares (INR 125.40 – 132.0 crore) |

| Offer For Sale | NIL |

| Total IPO size | 1,10,00,000 shares (INR 125.40 – 132.0 crore) |

| Minimum bid (lot size) | 125 shares (INR 15,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Akme Fintrade (India) Financial Performance

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | 86.17 | 67.44 | 69.51 | 53.41 |

| Expenses | 67.59 | 59.91 | 49.52 | 38.29 |

| Net income | 16.31 | 4.12 | 15.80 | 12.25 |

| Margin (%) | 18.93 | 6.11 | 22.73 | 22.94 |

Akme Fintrade (India) Offer News

- Akme Fintrade IPO Subscription Status

- Akme Fintrade (India) RHP

- Akme Fintrade DRHP

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Akme Fintrade Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 (Pre Issue) | FY 2024 (Post-Issue)* | |

| EPS | 5.15 | 1.30 | 4.98 | 3.83 |

| PE Ratio | – | – | 22.87 – 24.08 | 29.8 – 31.37 |

| FY 2021 | FY 2022 | FY 2023 | |

| RONW (%) | 13.57 | 3.09 | 9.25 |

| NAV | 41.09 | 43.17 | 64.60 |

| ROE (%) | 7.72 | 3.01 | 12.52 |

| EBITDA (%) | 78.80 | 64.18 | 69.45 |

| Debt/Equity | 2.44 | 3.63 | 4.42 |

Akme Fintrade IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 25 June 2024 | 25 | – | 2,100 |

| 24 June 2024 | 33 | – | 3,000 |

| 22 June 2024 | 46 | – | 3,500 |

| 21 June 2024 | 46 | – | 3,500 |

| 20 June 2024 | 42 | – | 3,400 |

| 19 June 2024 | 34 | – | 3,000 |

| 18 June 2024 | 32 | – | 2,800 |

| 17 June 2024 | 29 | – | – |

Akme Fintrade (India) IPO Objectives

The company proposes to utilize the Net Proceeds from the Fresh Issue towards funding the following objects:

- Augment the capital base of the company

- General corporate purposes

Akme Fintrade – Comparison With Listed Peers

| Company | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| Akme Fintrade (India) | 24.08 | 4.98 | 7.72 | 64.60 | 69.57 |

| MAS Financial Services | 20.81 | 37.18 | 13.55 | 277.83 | 990.26 |

| Shriram Finance | 8.87 | 160.54 | 13.82 | 1,162.12 | 30,508.39 |

| Cholamandalam Investment and Finance | 32.92 | 32.44 | 18.58 | 174.52 | 13,105.59 |

| Arman Financial Service | 17.16 | 110.47 | 25.65 | 430.61 | 423.90 |

| CSL Finance | 11.95 | 22.02 | 12.59 | 174.85 | 117.53 |

Aasaan Loans IPO Allotment Status

Aasaan Loans IPO allotment status is now available on Bigshare Services’ website. Click on this link to get allotment status.

Akme Fintrade IPO Dates & Listing Performance

| Aasaan Loans IPO Opening Date | 19 June 2024 |

| Aasaan Loans IPO Closing Date | 21 June 2024 |

| Finalization of Basis of Allotment | 24 June 2024 |

| Initiation of refunds | 25 June 2024 |

| Transfer of shares to demat accounts | 25 June 2024 |

| Akme Fintrade IPO Listing Date | 26 June 2024 |

| Opening Price on NSE | INR 127 per share (up 5.83%) |

| Closing Price on NSE | INR 133.35 per share (up 11.13%) |

Akme Fintrade IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

BP Wealth – Subscribe

Capital Market – Neutral

Canara Bank Securities – Subscribe

Choice Broking –

Dalal & Broacha –

Elite Wealth –

GCL Broking –

Geojit –

GEPL Capital – Subscribe

Hem Securities –

ICICIdirect –

Indsec –

Jainam Broking – Avoid

DR Choksey –

LKP Research –

Marwadi Financial – Subscribe

Systematix Shares –

Mehta Equities –

Nirmal Bang –

Reliance Securities –

Sushil Finance –

Samco Securities – Not rated

SBI Securities –

SMC Global –

SMIFS –

Swastika Investmart – Neutral

Ventura Securities – Subscribe

Akme Fintrade Offer Lead Manager

GRETEX CORPORATE SERVICES LIMITED

Office No. 13, 1st Floor, New Bansilal Building,

Raja Bahadur Mansion, 9-15, Homi Modi Street,

Fort, Mumbai– 400001, Maharashtra

Phone: +91-22-62280818

Email: [email protected]

Website: www.gretexcorporate.com

Akme Fintrade Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

S6-2, 6th Floor, Pinnacle Business Park,

Next to Ahura Centre, Mahakali

Caves Road, Andheri East, Mumbai – 400 093

Phone: +91 22 6263 8200

Email: [email protected]

Website: www.bigshareonline.com

Akme Fintrade Contact Details

AKME FINTRADE (INDIA) LIMITED

608, The Summit – Business Bay,

behind Guru Nank Petrol Pump, Opp. Cinemax,

Prakashwadi Andheri (East), Mumbai – 400069

Phone: +91- 294-2489501-02

Email: [email protected]

Website: www.aasaanloans.com

Akme Fintrade IPO FAQs

How many shares in Akme Fintrade IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

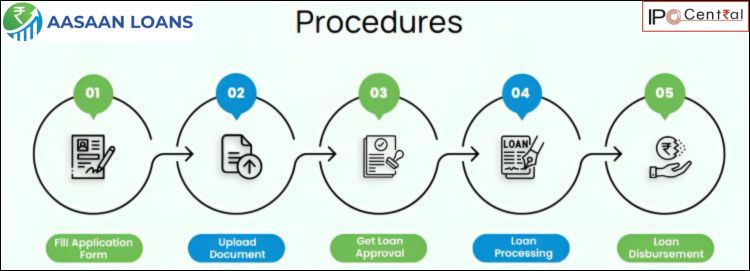

How to apply for an Akme Fintrade Public Offer?

The best way to apply for Akme Fintrade public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Akme Fintrade IPO GMP today?

Akme Fintrade IPO GMP today is INR 23 per share.

What is Akme Fintrade kostak rate today?

Akme Fintrade kostak rate today is INR NA per application.

What is Akme Fintrade Subject to Sauda rate today?

Akme Fintrade Subject to Sauda rate today is INR 2,100 per application.