Last updated on March 16, 2023

Harsha Engineers International, India’s largest manufacturer of bearing cages that are commonly used in the global automotive industry is all set to launch its initial public offering (IPO). The public offer will open for subscription on 14 September and will close on 16 September. Harsha Engineers International intends to raise INR755 crore through this initial public offering. Here are the top ten takeaways from the upcoming Harsha Engineers IPO.

Harsha Engineers IPO – Overview

Harsha Engineers International plans to raise INR755 crore through the IPO which includes a new issue of equity shares valued at INR455 crore and an offer-for-sale (OFS) by existing shareholders valued at up to INR300 crore. As part of the OFS, Rajendra Shah, Harish Rangwala, Pilak Shah, Charusheela Rangwala, and Nirmala Shah will dilute their ownership stakes.

The company has set aside 50% of the offer for qualified institutional buyers (QIB), 35% for retail investors, and 15% for non-institutional investors. The offer also includes a reservation for subscription by eligible employees. Investors can bid on a minimum of 45 shares, with a price band range of INR 314-330 per share.

| IPO Issue Opening Date | 14 SEP 2022 |

| IPO Issue Closing Date | 16 SEP 2022 |

| IPO Listing Date | 26 SEP 2022 |

| IPO Price Band | INR 314 – 330 per share |

| Document Links | DRHP, RHP |

| IPO Listing At | NSE, BSE |

| Offer for Sale | INR300 crore |

| Fresh Issue | INR455 crore |

CMR Green Technologies IPO GMP, Price, Date, Allotment

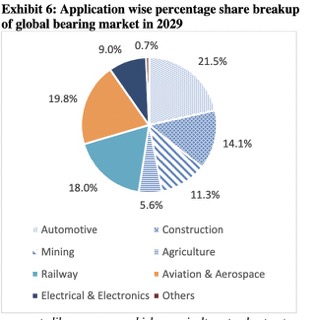

Harsha Engineers IPO – Industry Overview

Global economic growth, an increase in demand for customized bearings, a need for high performance bearings, technological advancements, and wind demand are growth drivers for the bearings industry.

The global bearing cage market is highly fragmented, with both global and regional players present. Nakanishi Metal Works Co Ltd (NKC; Japan), Harsha Engineers International Ltd (HEIL, India), MPT Prazisionstelle GmbH Mittweida (MPT Group Gmbh, Germany), and Manu Yantralaya Pvt Ltd (MYPT, India) are some of the key players in the global bearing cages market.

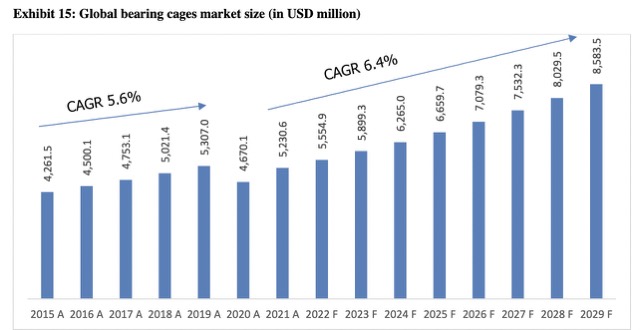

The global bearings market was valued at USD 85.2 billion in 2015 and grew to USD 106.1 billion in the year 2019 at a CAGR of 5.6% Owing to the global outbreak of Covid-19 since the end of March 2020, the bearings market contracted in 2020 due to decline in demand and supply chain.

However, a rebound was seen in 2021, with the market growing at a 12% annual rate to USD 104.6 billion in 2021, with the Asia-Pacific region emerging as one of the fastest growing regions. Bearings market is expected to grow at a CAGR of 6% to 8% from 2021 to 2029 and is estimated to be worth USD 171.7 billion in 2029.

Harsha Engineers IPO – Company Overview

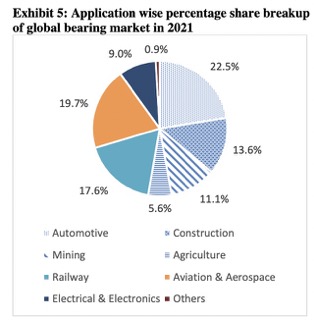

Harsha Engineers International was founded in 2010 and is India’s largest manufacturer of precision bearing cages by revenue in the organized sector. The company is divided into two divisions: engineering and solar EPC. Harsha Engineers International was able to manufacture more than 7,205 bearing cages and 295 other products for customers in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, and renewables sectors as of September 30, 2021.

Harsha Engineers controls roughly half of the organized bearing cages market in India. It also has a global presence, accounting for 6.5% of the global organized bearing cages market. These bearing cages are widely used in railways, aviation and aerospace, construction, mining, agriculture, electrical and electronics, renewables, and other industries.

Harsha Engineer International’s top five customers constitute 70.55%, 72.28%, and 72.54% of total revenue from operations for Fiscal 2022, Fiscal 2021 and Fiscal 2020, respectively. Harsha Engineer International also has over 10 years of operating history in the solar EPC business with an in-house design, engineering, procurement, project management and O&M team.

Harsha Engineers IPO – Global Presence

Harsha Engineer International’s engineering has four strategically located manufacturing facilities in Changodar, Moraiya, China, and Romania, which allows it to penetrate global markets more efficiently and cost-effectively and provides access to customers in over 25 countries across five continents, including North America, Europe, Asia, South America, and Africa. Harsha Engineers International has warehouses in over 20 countries around the world, including Europe, the United States, China, and South America, to help diversify its revenue geographically.

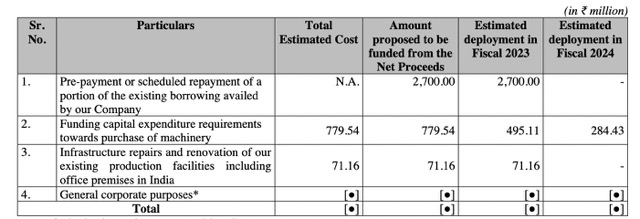

Harsha Engineers IPO – IPO Proceeds

Harsha Engineer International will use the IPO proceeds for the following purposes

- Prepayment or scheduled repayment of a portion of existing borrowing. The maximum proportion of IPO proceeds will be utilized for paying the debt – INR270 crore.

- Funding capital expenditure requirements towards the purchase of machinery – INR77.9 crore.

- Infrastructure repairs and renovation of existing production facilities including office premises in India – INR7.1 crore.

- General corporate purposes.

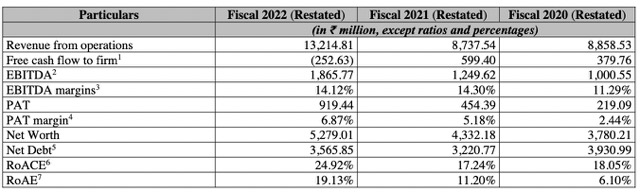

Harsha Engineers IPO – Financial Performance

Harsha Engineers reported INR1,321.48 crore in revenue from operations in FY2021-22, a jump of 51.24% over the previous year. Profit after tax for fiscal 2022 increased by 102.35% to INR91.94 crore from INR45.44 crore the previous year. This improvement was not limited to revenue and profits and was visible in other important metrics as well.

Harsha Engineers IPO – Valuation & Margins

| FY2019 | FY2020 | FY2021 | FY2022 | |

| EPS | 13.51 | 3.52 | 5.88 | 11.09 |

| PE ratio | – | – | – | 28.31 – 29.76 |

| RONW (%) | 18.75 | 5.80 | 10.49 | 17.42 |

| ROCE (%) | (79) | 13 | 17 | 23 |

| EBITDA (%) | (22.4) | 11.3 | 14.3 | 14.1 |

| Debt/Equity | 86.95 | 1.13 | 0.83 | 0.74 |

| NAV | – | – | 86.64 | 68.34 |

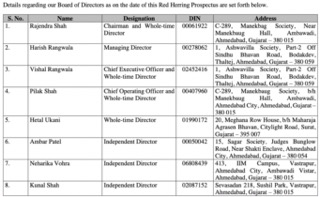

Harsha Engineers IPO – Management

The management of Harsha Engineer comprise of a diversed team with industry expereince on an average of more than 30 years.

Harsha Engineers IPO – Strengths

- Harsha Engineers International has manufactured over 7,500 different types of products in the automotive and industrial segments.

- Harsha Engineers serves clients from over 25 countries. In FY22, exports accounted for approximately 64% of engineering business revenue.

- Its average relationship with its top five customers spans more than a decade.

- Harsha Engineers International has five strategically located manufacturing facilities in India, China, and Romania.

- Harsha Engineers International also provides EPC (engineering, procurement, and construction) services in the solar photovoltaic industry, as well as operations and maintenance services in the solar sector.

Harsha Engineers IPO – Risk & Threats

- Harsha Engineer International relies heavily on its top five customers, who account for 71% of its revenue.

- Harsha Engineer has manufacturing units, and all operations necessitate a constant power supply. Any interruption in the power supply may result in production disruption.

- It reported a loss in financial year 2019.

- Its EPC solar business is vulnerable to risks such as price and availability increases in labour, equipment, and materials.

- The growing demand for EVs is estimated to have an impact on the bearing industry volumes.