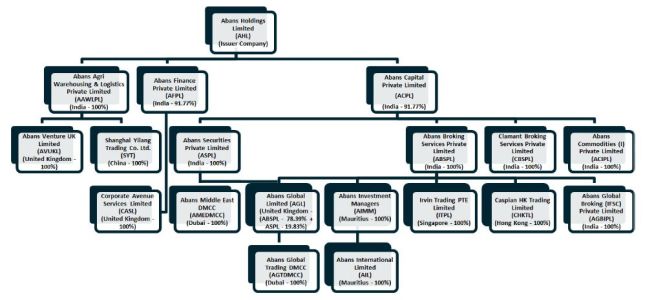

Abans Holdings IPO description – The company is a financial services arm of the Abans Group. It operates a diversified global financial services business, headquartered in India, providing NBFC services, global institutional trading in equities, commodities and foreign exchange, private client stock broking, depositary services, asset management services, investment advisory services and wealth management services to corporates, institutional and high net worth clients. Its business operations are mainly organized as under:

Finance Business: The company operates a RBI Registered NBFC (Non Deposit taking). Its Finance business is primarily focused on lending to private traders and other small and medium businesses involved in the commodities trading market.

Agency Business: Abans Holdings is a SEBI registered Stock and Commodity Exchange Broker with memberships across all the major stock exchanges in India, including BSE, NSE, MSEI, MCX, NCDEX and ICEX. Further being FCA registered financial services firm in London, it has direct/indirect memberships in various international exchanges like DGCX (Dubai), LME (London), INE and DCE (China). We are also a SEBI Registered Portfolio Management company as well as a SEBI Registered Category-I FPI.

Capital and other Business: The Capital Business includes its internal treasury operations which manage its excess capital funds investing capital in low / medium risk strategies, maintaining positions in physical as well as exchange traded commodities and other instruments.

Promoters of Abans Holdings – Mr. Abhishek Bansal

Abans Holdings IPO Details

| Abans Holdings IPO Dates | 12 – 15 December 2022 |

| Abans Holdings IPO Price | INR 256 – 270 per share |

| Fresh issue | 38,00,000 shares (INR 97.28 – 102.60 crore) |

| Offer For Sale | 90,00,000 shares (INR 230.40 – 243.00 crore) |

| Total IPO size | 128,00,000 shares (INR 327.68 – 345.6 crore) |

| Minimum bid (lot size) | 55 shares (INR 14,850) |

| Face Value | INR 2 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Abans Holdings Financial Performance

| FY 2019 | FY 2020 | FY 2021 | FY 2022 | 5M FY 2023 | |

| Revenue | 4,371.37 | 2,765.21 | 1,325.51 | 638.63 | 284.90 |

| Expenses | 4,339.34 | 2,729.50 | 1,282.26 | 580.44 | 258.47 |

| Net income | 42.03 | 34.83 | 41.90 | 56.88 | 27.28 |

| Margin (%) | 0.96 | 1.26 | 3.16 | 8.91 | 9.58 |

Abans Holdings Offer News

Abans Holdings Valuations & Margins

| FY 2019 | FY 2020 | FY 2021 | FY 2022 | |

| EPS | 7.62 | 8.46 | 9.88 | 13.37 |

| PE ratio | – | – | – | 19.15 – 20.19 |

| RONW (%) | 9.56 | 6.97 | 7.46 | 9.01 |

| NAV | – | – | 121.30 | 136.17 |

| Debt/Equity | – | 0.54 | 0.41 | 0.12 |

Abans Holdings IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 21 Dec 2022 | 5 | – | – |

| 20 Dec 2022 | – | – | – |

| 19 Dec 2022 | – | – | – |

| 17 Dec 2022 | – | – | – |

| 16 Dec 2022 | – | – | – |

| 15 Dec 2022 | 5 | – | – |

| 14 Dec 2022 | 10 | – | – |

| 13 Dec 2022 | 15 | – | – |

| 12 Dec 2022 | 12 | – | – |

| 10 Dec 2022 | 17 | – | – |

| 9 Dec 2022 | 15 | – | – |

| 8 Dec 2022 | 10 | – | – |

Abans Holdings IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

| Shares Offered | 12,80,000 | 38,40,000 | 76,80,000 | 1,28,00,000 |

| 15 Dec 2022 | 4.10 | 1.48 | 0.40 | 1.10 |

| 14 Dec 2022 | 2.19 | 0.17 | 0.32 | 0.46 |

| 13 Dec 2022 | 1.01 | 0.13 | 0.23 | 0.28 |

| 12 Dec 2022 | 0.00 | 0.00 | 0.00 | 0.00 |

| As on 07:00:00 PM |

Abans Holdings IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

Asit C Mehta –

BP Wealth – Avoid

Canara Bank Securities – Avoid

Choice Broking –

Dalal & Broacha –

Elite Wealth – Avoid

Geojit –

GEPL Capital – Avoid

Hem Securities – Subscribe

ICICIdirect –

Jainam Broking – Avoid

KR Choksey –

LKP Research –

Marwadi Financial –

Motilal Oswal –

Nirmal Bang –

Reliance Securities –

Religare Broking –

Samco Securities –

SMC Global – 1.5/5

Swastika Investmart –

Ventura Securities –

Abans Holdings Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

Office No. S6-2, 6th Floor,

Pinnacle Business Park, Next to Ahura Centre,

Mahakali Caves Road, Andheri East, Mumbai – 400 093

Phone: 022 – 6263 8200

E-mail: [email protected]

Website: www.bigshareonline.com

Abans Holdings Contact Details

ABANS HOLDINGS LIMITED

36,37,38A,Floor 3, Nariman Bhavan,

Backbay Reclamation, Nariman Point,

Mumbai – 400 021

Phone: +91 – 22 – 6179 0000

Email: [email protected]

Website: www.abansholdings.com

Abans Holdings IPO Allotment Status

Abans Holdings IPO allotment status is now available on Bigshare Services’ website. Click on Bigshare Services weblink to get allotment status.

Abans Holdings IPO Dates & Listing Performance

| Abans Holdings IPO Opening Date | 12 December 2022 |

| Abans Holdings IPO Closing Date | 15 December 2022 |

| Finalisation of Basis of Allotment | 20 December 2022 |

| Initiation of refunds | 21 December 2022 |

| Transfer of shares to demat accounts | 22 December 2022 |

| Abans Holdings IPO Listing Date | 23 December 2022 |

| Opening Price on NSE | INR 273 per share (up 1.1%) |

| Closing Price on NSE | INR 218.40 per share (down 19.11%) |

Abans Holdings IPO FAQs

How many shares in Abans Holdings IPO are reserved for HNIs and retail investors?

The investors’ portion in Abans Holdings IPO are QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in Abans Holdings Public Offer?

The best way to apply in Abans Holdings public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Abans Holdings IPO GMP today?

Abans Holdings IPO GMP today is INR 5 per share.

What is Abans Holdings kostak rate today?

Abans Holdings kostak rate today is INR NA per application.

What is Abans Holdings Subject to Sauda rate today?

Abans Holdings Subject to Sauda rate today is INR NA per application.