Last updated on November 15, 2023

ASK Automotive IPO Description – ASK Automotive is the largest manufacturer of brake-shoe and advanced braking (AB) systems for two-wheelers (2W) in India with a market share of approximately 50% in FY 2022 in terms of production volume for original equipment manufacturers (OEMs) and the branded independent aftermarket (IAM), on a combined basis.

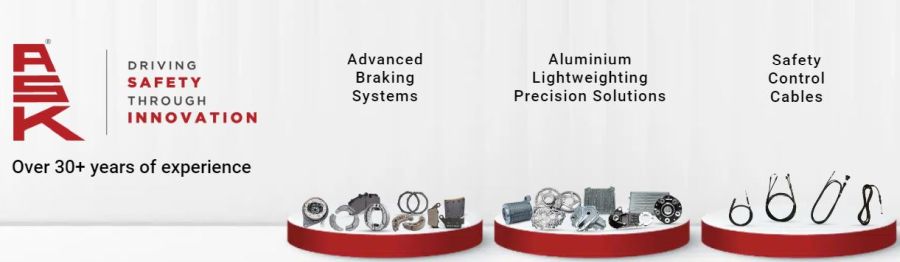

The company has been supplying safety systems and critical engineering solutions for more than three decades with in-house designing, developing, and manufacturing capabilities. Its offerings are powertrain agnostic, catering to electric vehicles (EV) and internal combustion engine (ICE) OEMs.

ASK Automotive has since diversified its operations to include offerings such as (i) AB systems; (ii) aluminum lightweighting precision (ALP) solutions, where it is a prominent player for 2W OEMs in India with a market share of 8% in FY 2022 in terms of production volume: (iii) wheel assembly to 2W OEMs; and (iv) safety control cables (SCC) products.

Promoters of ASK Automotive – Kuldip Singh Rathee, and Vijay Rathee

ASK Automotive IPO Details

| ASK Automotive IPO Dates | 7 – 9 November 2023 |

| ASK Automotive IPO Price | INR 268 – 282 per share |

| Fresh issue | NIL |

| Offer For Sale | 29,571,390 shares (INR 792.51 – 833.91 crore) |

| Total IPO size | 29,571,390 shares (INR 792.51 – 833.91 crore) |

| Minimum bid (lot size) | 53 shares (INR 14,946) |

| Face Value | INR 2 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

ASK Automotive Financial Performance

| FY 2021 | FY 2022 | FY 2023 | Q1 FY 2024 | |

| Revenue | 1,543.99 | 2,013.08 | 2,555.17 | 656.51 |

| Expenses | 1,420.40 | 1,905.99 | 2,390.63 | 612.12 |

| Net income | 105.76 | 83.59 | 122.94 | 34.83 |

| Margin (%) | 6.85 | 4.15 | 4.81 | 5.31 |

ASK Automotive Offer News

- ASK Automotive RHP

- ASK Automotive DRHP

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Subscription Status

ASK Automotive Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 5.22 | 4.09 | 6.18 |

| PE ratio | – | – | 43.37 – 45.63 |

| RONW (%) | 17.07 | 13.08 | 19.10 |

| NAV | 30.58 | 31.46 | 32.66 |

| ROACE (%) | 21.98 | 16.78 | 22.06 |

| EBITDA (%) | 13.40 | 9.00 | 9.65 |

| Debt/Equity | 0.13 | 0.25 | 0.49 |

ASK Automotive IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 14 November 2023 | 30 | 300 | 1,500 |

| 11 November 2023 | 40 | 300 | 1,600 |

| 10 November 2023 | 50 | 350 | 1,800 |

| 9 November 2023 | 47 | 350 | 1,800 |

| 8 November 2023 | 40 | 300 | 1,500 |

| 7 November 2023 | 35 | 300 | 1,500 |

ASK Automotive IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Shares Offered | 59,14,278 | 44,35,709 | 1,03,49,987 | 2,06,99,974 |

| 9 Nov 2023 | 142.41 | 35.47 | 5.69 | 51.13 |

| 8 Nov 2023 | 0.06 | 2.27 | 1.69 | 1.35 |

| 7 Nov 2023 | 0.03 | 0.41 | 0.57 | 0.38 |

ASK Automotive IPO Allotment Status

ASK Automotive IPO allotment status is now available on Link Intime’s website. Click on Link Intime IPO weblink to get allotment status.

ASK Automotive IPO Dates & Listing Performance

| ASK Automotive IPO Opening Date | 7 November 2023 |

| ASK Automotive IPO Closing Date | 9 November 2023 |

| Finalization of Basis of Allotment | 11 November 2023 |

| Initiation of refunds | 13 November 2023 |

| Transfer of shares to demat accounts | 15 November 2023 |

| ASK Automotive IPO Listing Date | 15 November 2023 |

| Opening Price on NSE | INR 303.3 per share (up 7.55%) |

| Closing Price on NSE | INR 310.1 per share (up 9.96%) |

ASK Automotive IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

Asit C Mehta –

BP Wealth – Subscribe

Canara Bank Securities – Subscribe for listing gains

Choice Broking – Subscribe

Capital Market – Neutral

Dalal & Broacha –

Elite Wealth –

GCL Broking –

Geojit –

GEPL Capital – Subscribe

Hem Securities – Subscribe

ICICIdirect –

Jainam Broking –

KR Choksey –

LKP Research –

Marwadi Financial – Subscribe

Mehta Equities – Subscribe

Motilal Oswal –

Nirmal Bang –

Reliance Securities – Subscribe

Religare Broking –

Samco Securities – Not Rated

SMC Global – 2/5

Swastika Investment – Subscribe

Ventura Securities – Not Rated

ASK Automotive Offer Lead Manager

ICICI SECURITIES LIMITED

ICICI Venture House, Appasaheb Marathe Marg

Prabhadevi, Mumbai 400 025, Maharashtra

Phone: +91 22 6807 7100

Email: [email protected]

Website: www.icicisecurities.com

ASK Automotive Offer Registrar

LINK INTIME INDIA PRIVATE LIMITED

C-101, 1st Floor, 247 Park L.B.S. Marg,

Vikhroli West, Mumbai – 400 083, Maharashtra

Telephone: +91 810 811 4949

Email: [email protected]

Website: www.linkintime.co.in

ASK Automotive Contact Details

ASK AUTOMOTIVE LIMITED

Plot No. 13, 14, Sector 5, IMT Manesar,

Gurugram 122 050, Haryana, India

Phone: +91 124 439 6907

Email: [email protected]

Website: www.askbrake.com

ASK Automotive IPO FAQs

How many shares in ASK Automotive IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in ASK Automotive Public Offer?

The best way to apply in ASK Automotive public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is ASK Automotive IPO GMP today?

ASK Automotive IPO GMP today is INR 30 per share.

What is ASK Automotive kostak rate today?

ASK Automotive kostak rate today is INR 300 per application.

What is ASK Automotive Subject to Sauda rate today?

ASK Automotive Subject to Sauda rate today is INR 1,500 per application.