Angel Broking IPO is scheduled to hit the primary markets on 22 September. The Mumbai-based company counts World Bank-arm International Finance Corporation (IFC) among its investors. A look at the company’s operations and performance in recent years shows IFC was spot on in identifying the potential in the business. Here are a few facts about Angel Broking IPO and the company’s operations that investors should know.

#1 Angel Broking IPO structure: Fresh + OFS

The IPO is priced in the range of INR305 – 306 per share and a total of INR600 crore will be mobilized by issuing fresh shares as well as through share sale by existing shareholders. While promoters and IFC plans to sell shares worth INR300 crore, a similar amount is expected to be raised through issuance of new shares. The IPO proceeds are proposed to be used towards:

- To meet working capital requirements – INR230 crore

- General corporate purposes

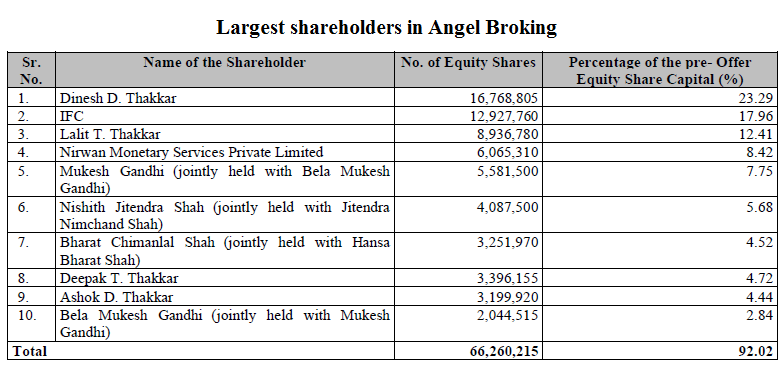

#2 Capital Structure: IFC on board

As mentioned above, the company has an external investor in the form of IFC which invested in 2007. Apart from IFC, Angel Broking has several other investors including Bharat Chimanlal Shah of ASK Investment Managers, Nishith Jitendra Shah and Mukesh Gandhi. Despite diluting equity, promoters and promoter group in the company are in the driving seat with 55.2% equity shareholding.

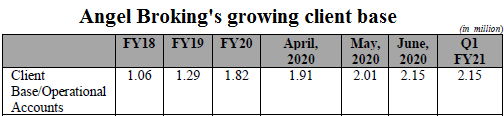

#3 Expanding user base

Angel Broking has expanded the number of its clients smartly in recent years. Its operational client base steadily grew from 1.06 million at the end of FY2018 to 2.15 million on 30 June 2020. While the client addition has picked pace in Q1 FY2021 as a result of Covid-19 lockdown, Angel’s performance has been quite steady in the prior years, thanks to a judicious use of performance marketing, referrals, digital influencers, and an 11,000 people-strong Authorised Person Network.

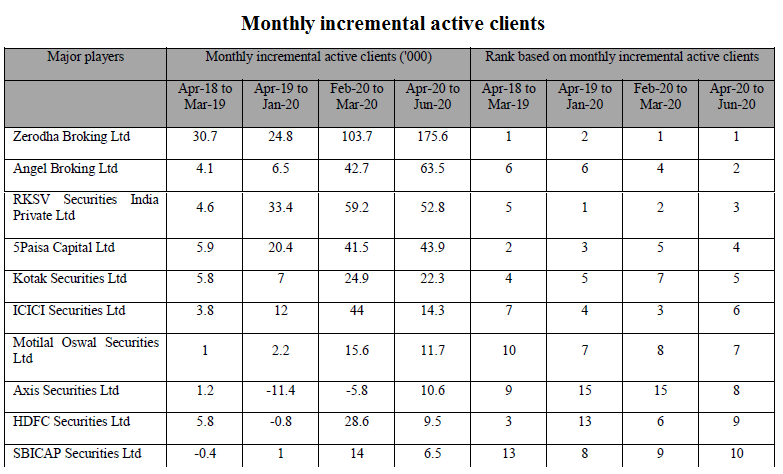

Angel Broking is numero uno in Authorised Persons and fourth largest in terms of active clients on NSE as of 30 June 2020. In fact, Angel has been among the leaders when it comes to adding new clients during lockdown. It was placed second during the quarter.

As India took to stock trading during lockdown, Angel Broking’s average daily turnover surged from INR253,176 million in Q1FY20 to INR618,945 million in Q1FY21. Over the long term too, the company has consistently expanded its market share in terms of retail turnover with Cash Market Share increasing to 17.3% in Q1FY2021 from 8.5% in FY2018, F&O Market Share increasing to 7.8% in Q1FY2021 from 2.9% in FY2018; Commodity Market share increasing to 24.6% in Q1FY2021 from 8.8% in FY2021.

Fun fact from RHP: Angel Broking’s customer outreach spans across approximately 97% or 18,649 pin codes in India as of 30 June 2020.

#4 Angel Broking IPO Facts: Improving profitability

Broking is a cyclical business but thankfully, last few years have been kind to brokerage houses and Angel Broking is no exception. The company was also suitably aided by diversified product basket across segments, robust infrastructure, and competitive prices. While its top line has stagnated in the recent years, it needs to be seen in the context of rising broking revenues being offset by other revenues including interest from lending activities, income from depository operations, portfolio management services fees, and income from distribution activity among others. From FY2018 to Q1 FY2021, the share of brokerage income actually moved up from 62.6% to 74.7%.

This shift towards broking business, coupled with shutting down of some non-core businesses in the wellness domain has resulted in better profitability which stood at 19% in the latest quarter, up substantially from 13.8% in FY2018.

Angel Broking’s financial performance (in INR crore)

| FY2018 | FY2019 | FY2020 | Q1 FY2021 | |

| Revenue | 780.0 | 784.1 | 754.7 | 246.6 |

| Expenses | 620.0 | 655.9 | 635.9 | 182.0 |

| Net income | 107.3 | 79.6 | 81.4 | 46.9 |

| Net margin (%) | 13.8 | 10.2 | 10.8 | 19.0 |

#5 Deleveraging balance sheet

A leaner balance sheet has played an important role in achieving better profitability as explained above. A look at the the company’s debt and equity structure in recent years clearly shows a trend towrads deleveraging. The reduction in debt/equity ratio from 2.4 in FY2018 to less than 1 in FY2020 has not only been fueled by lowering debt but also by a corresponding rise in equity reserves indicating a healthy trend. Lower debt on books is always a welcome step and Angel scores very well on this front.

Reducing Debt, Growing Reserves (INR mil.)

| FY2018 | FY2019 | FY2020 | Q1 FY2021 | |

| Debt | 11,374.28 | 8,718.18 | 4,908.79 | 6,580.06 |

| Equity Share Capital | 719.95 | 719.95 | 719.95 | 719.95 |

| Reserves and Surplus | 4,015.79 | 4,594.40 | 5,194.24 | 5,670.85 |

| Equity | 4,735.74 | 5,314.35 | 5,914.19 | 6,390.80 |

| Debt/Equity | 2.4 | 1.6 | 0.8 | 1.0 |

Stay tuned for more on Angel Broking IPO, we intend to publish a detailed analysis of the offer. Meanwhile, please head to this page to check the latest grey market price movements.