Later this month, Mahindra Logistics will launch its IPO but the offer is already actively traded in the grey market at a premium. The company, part of Mahindra & Mahindra (M&M) group, is a third party logistics services provider. Investors will be keeping a close watch on the IPO which is first public offer from the M&M Group in a long time. Here are some important points to know about the company.

M&M as promoter (and biggest client)

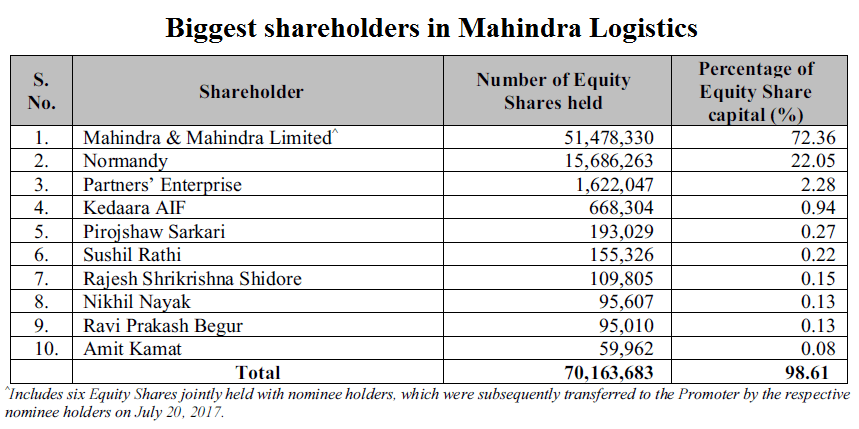

M&M is the corporate parent and promoter of Mahindra Logistics and holds 72.36% equity stake in the logistics player. In fact, the logistics business operated as a division of M&M serving the transportation and distribution, warehousing and in-factory logistics requirements of the group prior to 2008. Subsequently, the business was transferred to Mahindra Logistics. Understandably, the group is the biggest client of Mahindra Logistics, accounting for over 55% of the latter’s annual revenues. However, Mahindra Logistics’ dependence on M&M has come down in recent years. In 2015, the group contributed over 70% to Mahindra Logistics’ top line. The experience gained from serving M&M has helped the logistics arm to win additional business from automotive clients including Volkswagen, BMW and Ashok Leyland.

Read Also: Reliance Nippon Life Asset Management IPO Review: Riding the SIP wave

Kedaara Capital on board too

Private equity (PE) firm Kedaara Capital came on board and invested in the company in 2014. The PE firm invested through Kedaara AIF and Normandy Holdings and currently holds a shade below 23% in Mahindra Logistics through its investment of INR200 crore.

Asset-light business model

This new buzzword means that the company does not own the assets required to operate the business. As a result, assets necessary for its operations such as vehicles and warehouses are owned or provided by a large network of business partners. This Uber-like approach has obvious benefits in better managing demand fluctuations while also minimizing the adverse effects resulting from cyclical movements. It also helps in reducing capital expenditure requirements, mitigating the effects of operational risks relating to direct fuel costs, maintenance costs and depreciation risks emanating from changes in laws and regulations.

Mahindra Logistics IPO: All OFS, no fresh shares

Mahindra Logistics IPO will not involve sale of fresh shares and all the shares in the offer will be sold by existing shareholders through an Offer for Sale (OFS). As a result, the company will not get any funds from the IPO and all proceeds will go to the selling shareholders.

M&M, which currently owns 51,478,330 shares or 72.36% equity stake, plans to sell 9,666,173 shares. Another major chunk of 9,271,180 shares will be offered by Normandy while Kedaara AIF plans to sell 394,993 shares.

Profitable but not highly

Mahindra Logistics has scaled pretty fast in recent years as the following table explains through the consistently-rising topline. Its asset light business model as well as the strong brand name of Mahindra helped in expanding revenues at a fast rate. At the same time, the company has maintained the trend of growing profits in all years, except in FY2016. Consistency with profits is rewarded very well in the stock market but Mahindra Logistics has slim margins ranging between 1.6% and 2.1% in the last five years.

|

Mahindra Logistics’ financial performance (in INR crore) |

||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | Q1 FY2018 | |

| Total revenue | 1,535.5 | 1,757.0 | 1,939.6 | 2,077.1 | 2,676.3 | 854.5 |

| Total expenses | 1,499.4 | 1,702.7 | 1,880.3 | 2,021.2 | 2,608.4 | 831.0 |

| Profit after tax | 24.4 | 36.6 | 39.2 | 36.3 | 45.2 | 15.0 |

| Net margin (%) | 1.6 | 2.1 | 2.0 | 1.7 | 1.7 | 1.8 |

FY2013, FY2014 figures based on Indian GAAP, subsequent years based on Ind AS

No dividend policy

While the company has been profitable, it does not have a formal dividend policy. Mahindra Logistics is in growth mode and has not paid any dividend in the last five years.

IPO price band and valuation

The company has fixed the price band of INR425 – 429 per share for selling the shares. It had Earnings Per Share (EPS) of INR6.62 in the latest year ended 31 March 2017. This means the public offer is priced in the Price/Earnings (P/E) range of 64.20 – 64.80. The company had a Return on Net Worth (RONW) of 13.11% for the latest year. Mahindra Logistics had a Net Asset Value (NAV) of INR51.13 per share as of 31 March 2017. This translates into a Price/Book Value (P/B) ratio of 8.39 at the upper price band.

We will publish a detailed analysis of Mahindra Logistics IPO in due time. Meanwhile, feel free to check out the discussion page to see how investors are reacting to pricing, valuations and grey market rates.