Medi Assist, a leading third-party administrator (TPA) for insurance companies in India with a dominant market share, is preparing for its IPO next week. Having nearly five times the market share of its nearest competitor, the company is an exciting prospect for investors. In Medi Assist Healthcare IPO review, IPO Central tries to provide an overview of the company’s business and assess its investment potential.

Medi Assist Healthcare IPO Analysis: A Brief Overview

Insurance companies play a vital role in protecting people from unexpected healthcare costs, but do insurance companies take the entire charge of the claim processing function? Not really! That’s where third-party administrators like Medi Assist comes in. They act like a facilitator between insurance companies and policy holders, taking over the claim processing process. Insurance companies mainly set up premium rates, manage risk and enroll policy holders. TPAs like Medi Assist then handle the day-to-day claim processing tasks.

Medi Assist Healthcare, through its wholly-owned subsidiaries Medi Assist TPA, Medvantage TPA, and Raksha TPA, holds a significant 33.67% market share in the retail and group TPA segment. Their extensive network comprises 18,754 hospitals across 1,069 cities and towns across 31 states and work along 35 insurance companies in India and globally.

As of FY 2023, the company managed a staggering INR 145,746.49 million of health insurance premiums. Notably, their claim settlement process boasts a 66% cashless claim settlement ratio and a 30% reimbursement claim settlement ratio.

Medi Assist Healthcare IPO Review: Competitive Edge

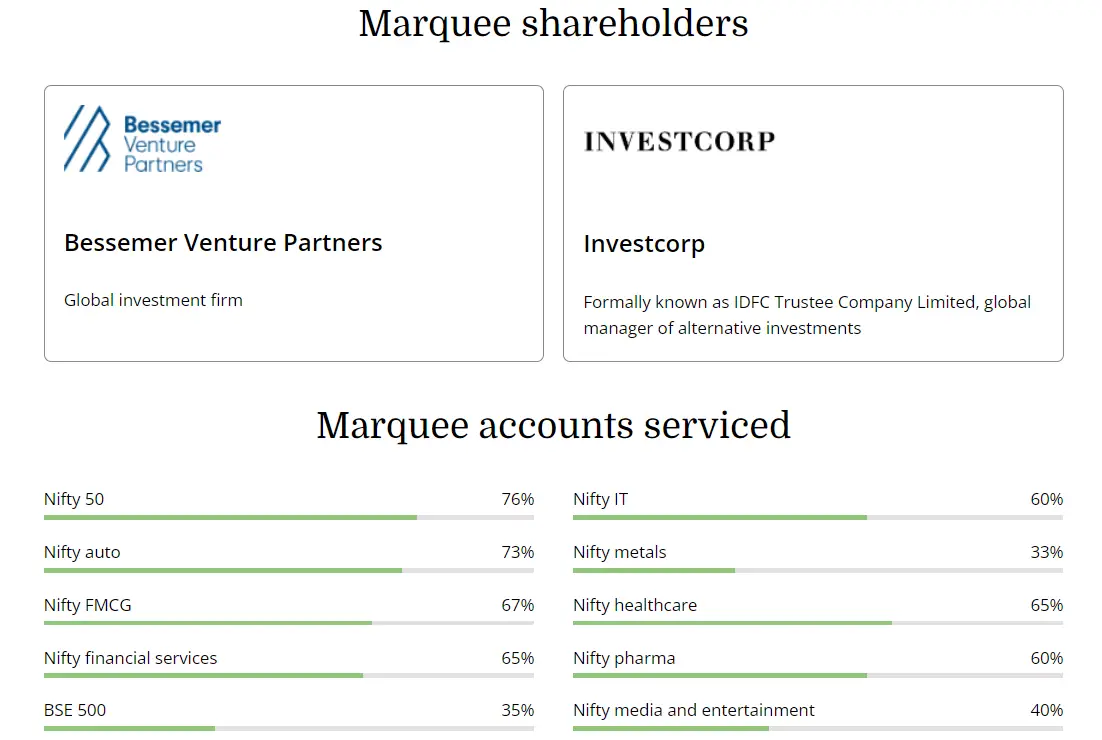

Medi Assist Healthcare is by far the largest in terms of revenue as well as profits in TPA Industry. It has a diversified client base, including 76% of Nifty 50 and 35% of BSE companies, as it serves corporate accounts of these companies with whom it enjoys a long-standing relationship. It has partnered with both central and state governments to administer various public healthcare programs. As of March 31, 2023, Medi Assist healthcare has serviced around 15 government-sponsored insurance schemes covering over 177.5 million lives.

In 2023, it processed and settled 5.27 million claims, comprising 2.44 million in-patient claims and 2.83 million outpatient claims which is highest compared to its competitors. The company’s scalable technology-enabled infrastructure streamlines claim processing, facilitates network management, and provides data analytics insights, Medi Assist has a strong competitive edge in the TPA market segment.

Medi Assist Healthcare IPO Analysis: Issue Structure

Medi Assist Healthcare IPO will be open for subscription from 15th January 2024, and the issue price has been anticipated to be around INR 397 to 498 per share with total issue size of INR 1,171.6 crore compromising of 28,028,168 shares which is entirely an Offer For Sale (OFS) by existing shareholders (including Bessemer and Investcorp) which means the company wouldn’t get any proceeds from the IPO. Out of the total 28,028,168 shares, 35% have been reserved for retail investors.

Medi Assist Healthcare IPO Analysis: Financial Performance

| Particulars (in crore) | FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 |

| Revenue | 322.74 | 393.81 | 504.93 | 301.96 |

| Expenses | 284.53 | 333.95 | 415.35 | 260.62 |

| Net income | 26.27 | 64.22 | 74.04 | 22.49 |

| Net income margin (%) | 8.14 | 16.31 | 14.66 | 7.45 |

Medi Assist’s market share in the TPA segment has been increasing with consistently improving financials. Its operational revenue saw a substantial increase, rising by 56.5% from INR 322.7 crore in FY 2021 to INR 504.9 crore in FY 2023.

Concurrently, the Profit After Tax (PAT) grew from INR 26.3 crore in FY 2021 to INR 74 crore in FY 2023. The strong financials coupled with debt-free balance sheet and double-digit net margin, makes it an attractive and scalable business. A strong financial performance is hard to miss and it is no different in Medi Assist Healthcare IPO Review!

Medi Assist IPO Review: Peer Comparison

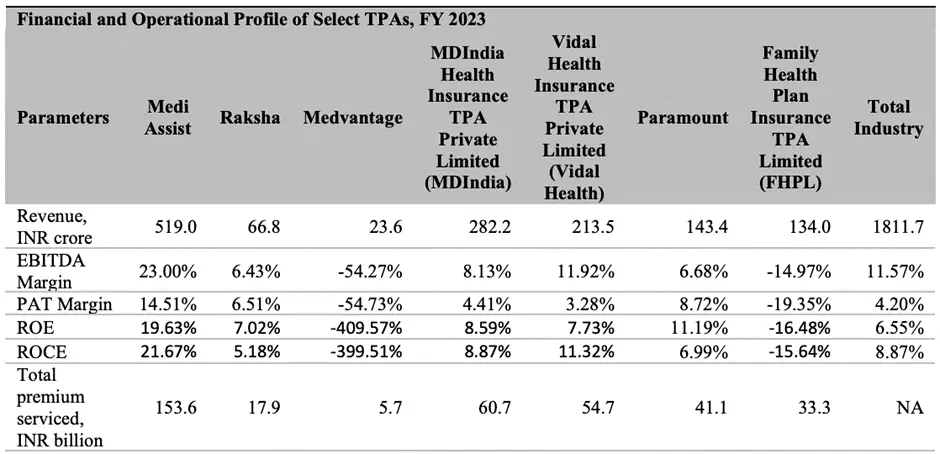

Medi Assist is poised to be the first listed TPA company in India as it has no listed competitors. To understand its competitive position, let’s compare the financials of Medi Assist and its indirect subsidiaries Raksha and Medvantage against unlisted rivals in the TPA industry.

Medi Assist and its subsidiaries control the largest market share, encompassing roughly 33% of the industry’s revenue. Compared to its peers, Medi Assist boasts a healthy ROE of 19.6% and ROCE of 21.6%, along with a profit margin of 14.51%. While Raksha’s profit margin stands at 6.51%, Medvantage is yet to turn profitable.

From the data mentioned in the table above, it is clear that Medi Assist has capitalized well on its market leadership advantage. Its margins are way above its competitors such as MDIndia Health Insurance TPA and Paramount.

Medi Assist IPO Review: Should you Invest?

Medi Assist Healthcare, a prominent player in the health insurance TPA space, boasts robust financials with a 35.67% CAGR in group and retail health insurance premiums in the last three years.

Over the last five years, health insurance density has grown at a compounded rate of 18.6% in India and yet, only 15.2% of the population in FY 2022 was covered under private health insurance. This is indicative of high growth rate to continue in the industry in the coming years.

With health insurance steadily gaining importance in India, the TPA segment is poised for strong growth. As a first-mover in this sector, Medi Assist is well-positioned to capitalize on this trend. Its technology-driven infrastructure and extensive network give the company significant potential for future expansion.

In all these years of its operations, the company management led by Dr. Vikram Jit Singh

Chhatwal has demonstrated a remarkable combination of maturity and agility to bring operations at current scale. The management has remained aware of competition and has undertaken opportunistic acquisitions without overpaying. As a result, Medi Assist Healthcare has a debt-free balance sheet which can be leveraged for acquisitions in the coming years. The management has indicated that it remains open to acquisition opportunities in order to expand existing service offerings, increase market share in existing markets, or expand to new geographies.

The IPO price of INR 397 – 418 per share translates into a PE ratio range of 36.66 – 38.60. For the latest year, its ROCE stood at an impressive 24.95% while EBITDA margin was at 25.7%.

In our Medi Assist Healthcare IPO review, what we see in the company is a robust business model in a growing industry, backed by a capable management that has kept the balance sheet clean. Considering these positives, the asking price appears attractive although there are no listed peers for comparison. Positive activity in grey market is an added bonus for investors.