Precision Camshafts is going to be the first IPO to be launched in India in 2016. The Solapur-based company, which cranks out over 150 varieties of camshafts for passenger vehicles, tractors, light commercial vehicles and locomotive engine, has fixed the price band between INR180 to INR186 per share for the IPO. Precision Camshafts IPO will open on 27 January and will close on 29 January. Precision Camshafts IPO will involve a fresh issue of INR240 crore and an offer for sale (OFS) of up to 91.5 lakh shares. The OFS component indicates an increase from the earlier plan of selling 86.4 lakh equity shares through the route, as mentioned in the draft prospectus.

At the upper end of the price band, Precision Camshafts IPO will raise INR410 crore. The minimum bid lot is 80 equity shares and thereafter in multiples of 80 shares. Subsequent to the conclusion of the IPO, Precision Camshafts’ shares will be listed on NSE and BSE.

Yatin Shah, Suhasini Shah, Jayant Aradhaye, and Cams Technology Limited are among the investors looking at partially selling their shareholding in the company. Precision Camshafts IPO will bring INR240 crore to the company and majority of the proceeds will be used to establish a machine shop for ductile iron camshafts at the Solapur plant.

Precision Camshafts impresses with growth

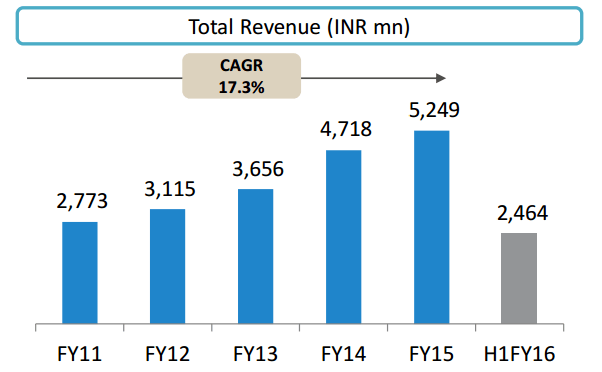

With an exception of FY 2014, Precision Camshafts’ financial performance is impressive with an average revenue growth of 17.3% in the last four years.

Precision Camshafts IPO will also be the first one to be introduced under the new T + 6 rule. This essentially means that listing of shares will be on the sixth day after applications are closed. Although it may not look a big development, the compression from T+12 to T+6 is nothing short of an achievement and market regular SEBI deserves full points for this investor-friendly step. This will also be the first time that the entire IPO process becomes cheque-free as Application Supported by Blocked Amount (ASBA) has been made mandatory now by SEBI.

Read Also: Courtesy SEBI, IPO listing in T+6 days starting January 2016

Following last year’s amazing returns, Precision Camshafts IPO may be an excellent opportunity for investors to make smart money in short term. However, the secondary market is not exactly exciting and supportive of new public offerings. As a result, any investment decision needs to be exercised with caution and given an exceptionally strong IPO pipeline, there is absolutely no need to be in a hurry. IPO Central intends to help investors in this task by reviewing the IPO at a greater depth in the coming days.