PE Analytics – the company behind PropEquity – platform is coming up with an IPO. The upcoming IPO aims to raise INR31.6 crore through a mix of fresh issues shares and an offer for sale. Priced in the range of INR111 – 114 per share, the company has lots of factors going in its favor. In our PropEquity IPO review, here are some quick thoughts.

PropEquity Business Description

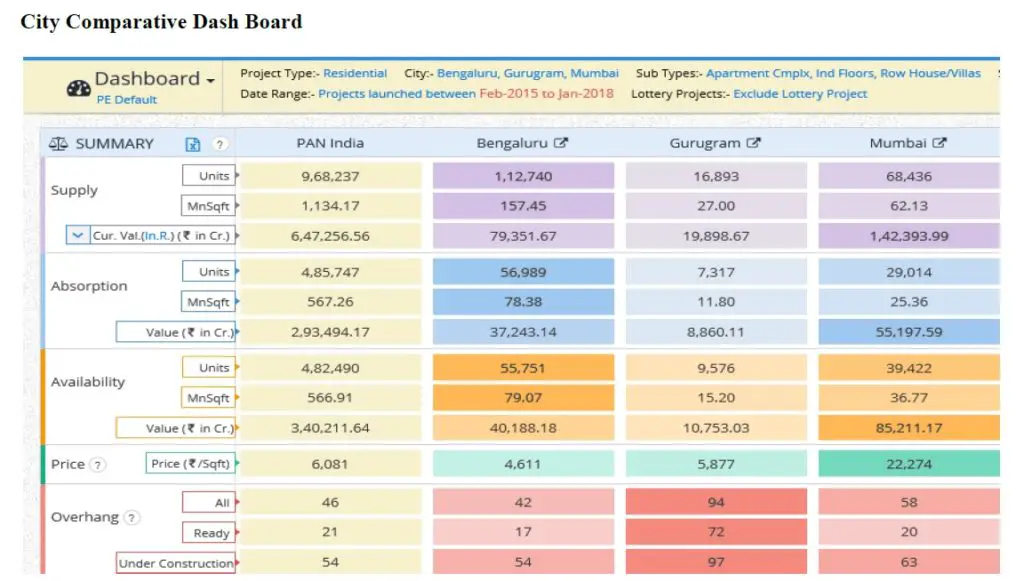

PropEquity is a real estate business intelligence and analytics platform catering to a variety of users such as developers, construction industry, investors, banks, housing finance companies, equity research firms, real estate PE funds, REIT’s, financial institutions, mortgage insurers, HNIs, lenders and investors in real estate.

Its proprietary database covers 44 Indian cities and features over 180 data points over 13 years and over 156 months on month data base. It has coverage of over 42,000 developers, over 1,36,000 projects in India and over 97,00,000 units. Some of the data points include supply-demand dynamics, vacancy trend, rental value trend, price movement, capital value trend, absorption rate and inventory levels.

In addition, the company carries out customized research & consulting assignments for more specific insights in micro markets that clients require to assess for accurate decision making. This business line includes Location Advisory, Development Consulting, Strategic Consulting, Research and City Reports.

PropEquity IPO Review: Financial Performance

A look at the company’s financial performance in the recent years gives more confidence with regards to its operations and the management’s ability to navigate through difficult times. Revenue growth has been consistent in the last 3 years and the company is on track to post higher revenues this year as well.

The movement in profits has not been similarly consistent and even included a decline in FY 2020 but that is on expected lines given the impact of COVID-19 pandemic. Additionally, the company booked losses on account of loss on trading futures & option in equity market (red flag).

Nevertheless, the company’s latest six-month results are indicative of higher profits in FY2022 over FY2021. Another point worth highlighting is that the margins are quite healthy.

| FY2019 | FY2020 | FY2021 | H1 FY2022 | |

| Revenue | 16.13 | 17.24 | 19.76 | 12.15 |

| Expenses | 11.34 | 15.73 | 10.47 | 6.52 |

| Net income | 3.48 | 1.17 | 6.92 | 4.11 |

Figures in INR Crore unless specified otherwise

PropEquity IPO Review: Should you subscribe?

Even though it is an SME IPO and the requirements for SME IPOs are vastly different from mainboard IPOs, it is worth highlighting that the positives in case of PropEquity IPO seem to be outweighing the concerns regarding SME IPOs. It is pretty clear that the company operates in an industry which has withstood the test of time and its products are going to witness more and more demand from not just real estate companies but also other stakeholders in the industry.

It is also very clear that PE Analytics has demonstrated a successful track record so far when the real-estate industry was battling sluggish demand. As the end-user demand scenario improves in the real estate industry, it is only natural that the demand of PE Analytics’ services and database also goes up.

In terms of its internal factors, the company has no debt on its balance sheet while the promoters have also stayed away from paying themselves in an excessive manner. While competition in this space is heating up (venture-funded PropStack is an example), PE Analytics appears to be well-placed with its longstanding relationships with clients.

As stated above, the company’s financial performance has been top notch and there is little to doubt that this performance will not be repeated in future. There has not been any mentioned of Futures and Options trading except in FY2020 which leads us to believe the company isn’t indulging in this activity now.

This naturally leads us to valuations since everything else appears to be in place. Going by the EPS of INR7.67 in FY2021, the IPO pricing works out to a PE ratio (pre-IPO) of 14.86 on the upper end of the pricing band. This is very attractive considering the PE ratio of over 70 for the recently-listed LatentView Analytics. Its Return on Net Worth (RONW) of 25.8% for FY2021 is also higher than LatentView’s 20.89%.

Clearly, valuations are quite reasonable and appear to be leaving ample headroom for post-listing growth. While PropEquity IPO review is positive on most points, we also found a big red flag and thus, eventual investment decision has to be based on investor’s risk appetite.