AU Financiers has filed its draft red herring prospectus (DRHP) with market regulator SEBI to bring its much awaited IPO. AU Financiers IPO will be managed by ICICI Securities, HDFC Bank, Motilal Oswal Investment Advisors, and Citigroup Global Markets India. Shares of AU Financiers proposed to be listed on NSE and BSE.

AU Financiers has filed its draft red herring prospectus (DRHP) with market regulator SEBI to bring its much awaited IPO. AU Financiers IPO will be managed by ICICI Securities, HDFC Bank, Motilal Oswal Investment Advisors, and Citigroup Global Markets India. Shares of AU Financiers proposed to be listed on NSE and BSE.

AU Financiers IPO – Full OFS

According to the prospectus, a total of 53,422,169 shares will be offered in AU Financiers IPO which will be entirely an offer for sale (OFS) by existing shareholders. As a result, the company will not receive any funds from the offer.

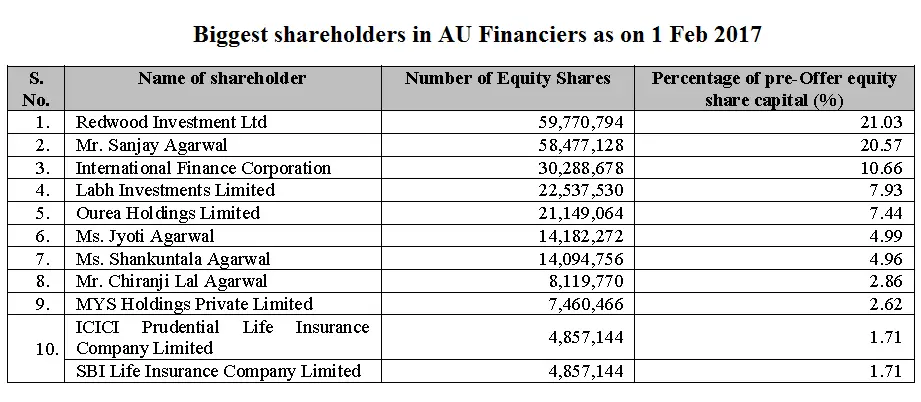

AU Financiers IPO will offer an exit route to existing investors in the company and the Jaipur-based company has a long list of marquee investors. These include Redwood Investment Ltd, World Bank’s International Finance Corporation (IFC), Kedaara Capital’s Ourea Holdings, ChrysCapital’s Labh Investments, ICICI Prudential Life Insurance and SBI Life Insurance. Apart from these external investors, promoters Sanjay Agarwal, Jyoti Agarwal, Shakuntala Agarwal, and Chiranji Lal Agarwal will also sell some shares.

Here is something positive from the prospectus – none of the external investors will be making a full exit from AU Financiers.

Here is something positive from the prospectus – none of the external investors will be making a full exit from AU Financiers.

Read Also: Upcoming IPOs in 2017 to keep an eye on

Financial performance

Mostly, companies backed by private equity (PE) investors tend to do well and AU Financiers is no exception. AU Financiers boasts of an awesome track record of increasing revenues and profits in each of the last four years.

|

AU Financiers’ financial performance (in INR crore) |

|||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Total revenue | 230.7 | 413.1 | 571.3 | 689.4 | 1,051.9 |

| Total expenses | 175.3 | 310.4 | 461.7 | 482.1 | 674.7 |

| Profit after tax | 37.3 | 69.4 | 72.5 | 139.4 | 247.1 |

Source: AU Financiers’ DRHP

Given the robust financial performance of AU Financiers in recent years, investors will be looking forward to the IPO with high expectations.

AU Financiers – Small Finance Bank

AU Financiers is one the 10 companies which have received RBI’s approval to set up small finance bank. The clearance has some caveats such as bringing down foreign shareholding to 49% and selling some businesses which might create conflict of interest. Owing to these regulations, Equitas Holdings and Ujjivan Financial Services brought their IPOs last year which rewarded investors handsomely. AU Financiers has already brought its foreign shareholding to 49% as some of the investors including Kedaara Capital, ChyrsCapital, IFC, and Warburg Pincus partly exited the company. In the deal, Motilal Oswal Private Equity made a complete exit.