TBO Tek IPO Description –

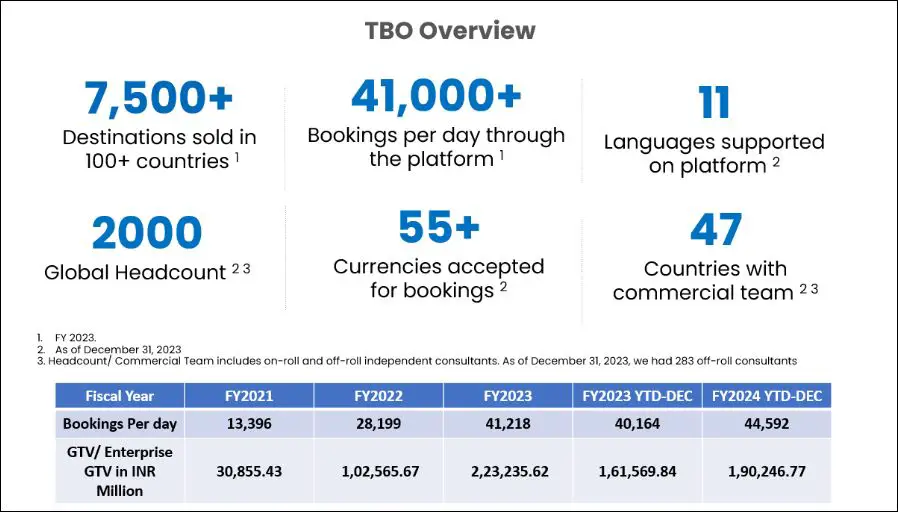

TBO Tek is a major global travel distribution platform that connects more than 159,000 buyers in over 100 countries with over one million suppliers as of 31 December 2023. The platform consists of two portals: TBO Holidays, which serves as a global travel distribution platform, and Travel Boutique Online, which caters specifically to travel buyers in India.

The company streamlines the travel business for suppliers like hotels, airlines, car rentals, transfers, cruises, insurance, rail, and others, as well as retail buyers such as travel agencies and independent travel advisors. As of 31 December 2023, TBO Tek employs 449 sales team members across 43 countries. This team plays a crucial role in driving the company’s business growth.

As of 31 December 2023, the company had a global headcount of 2,000, including off-roll employees.

Promoters of TBO Tek – Ankush Nijhawan, Gaurav Bhatnagar, Manish Dhingra, Arjun Nijhawan, and LAP Travel Private Limited

Table of Contents

TBO Tek IPO Details

| TBO Tek IPO Dates | 8 – 10 May 2024 |

| TBO Tek Issue Price | INR 875 – 920 per share |

| Fresh issue | INR 400 crore |

| Offer For Sale | 12,508,797 shares (INR 1,094.52 – 1,150.81 crore) |

| Total IPO size | INR 1,494.52 – 1,550.81 crore |

| Minimum bid (lot size) | 16 shares (INR 14,720) |

| Face Value | INR 1 per share |

| Retail Allocation | 10% |

| Listing On | NSE, BSE |

TBO Tek Financial Performance

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | 141.81 | 483.27 | 1,064.59 | 1,023.75 |

| Expenses | 176.81 | 470.46 | 914.42 | 858.74 |

| Net income | (34.14) | 33.72 | 148.49 | 154.18 |

| Margin (%) | (24.07) | 6.98 | 13.95 | 15.06 |

TBO Tek Offer News

TBO Tek Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 (Pre Issue) | FY 2024 (Post-Issue)* | |

| EPS | (3.28) | 3.34 | 14.25 | 18.95 |

| PE Ratio | – | – | 61.4 – 64.56 | 46.18 – 48.56 |

| FY 2021 | FY 2022 | FY 2023 | |

| RONW (%) | (16.73) | 14.54 | 44.04 |

| NAV | 19.58 | 22.26 | 32.36 |

| ROCE (%) | – | – | – |

| EBITDA (%) | (16.00) | 5.95 | 17.08 |

| Debt/Equity | – | – | – |

TBO Tek IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 14 May 2024 | 450 | – | 2,300 |

| 13 May 2024 | 510 | 650 | 2,500 |

| 11 May 2024 | 510 | 650 | 5,000 |

| 10 May 2024 | 505 | 650 | 5,000 |

| 9 May 2024 | 520 | 600 | 5,500 |

| 8 May 2024 | 485 | 780 | 4,900 |

| 7 May 2024 | 500 | 800 | 5,000 |

| 6 May 2024 | 460 | 800 | 5,800 |

| 4 May 2024 | 425 | – | 5,000 |

| 3 May 2024 | 350 | – | – |

TBO Tek IPO Objectives

The company proposes to utilize the Net Proceeds from the Fresh Issue towards funding the following objects:

- Investment in technology and data solutions by the company – INR 135 crore

- Investment in the Material Subsidiary, Tek Travels DMCC, for onboarding platform users through marketing and promotional activities; and hiring sales and contracting personnel for augmenting its Supplier and Buyer base outside India – INR 100 crore

- Investment in sales, marketing, and infrastructure to support the organization’s growth plans in India – INR 25 crore

- Unidentified inorganic acquisitions – INR 40 crore

- General corporate purposes

TBO Tek IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Employee | Total |

|---|---|---|---|---|---|

| Shares Offered | 50,47,205 | 25,23,602 | 16,82,401 | 32,608 | 92,85,816 |

| 10 May 2024 | 125.51 | 50.36 | 24.50 | 16.71 | 86.40 |

| 9 May 2024 | 0.17 | 8.19 | 10.01 | 6.55 | 4.15 |

| 8 May 2024 | 0.01 | 2.08 | 3.14 | 2.23 | 1.15 |

Shares allotted to anchor investors are not included in these calculations. Similarly, shares allotted to market makers, if any, are not part of these calculations.

TBO Tek – Comparison With Listed Peers

| Company | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| TBO Tek | 64.56 | 14.25 | 44.04 | 32.36 | 1,064.59 |

| RateGain Travel Technologies | 113.31 | 6.33 | 9.64 | 65.67 | 565.13 |

TBO Tek IPO Allotment Status

TBO Tek IPO allotment status is now available on the KFin Tech website. Click on this link to get allotment status.

TBO Tek IPO Dates & Listing Performance

| IPO Opening Date | 8 May 2024 |

| IPO Closing Date | 10 May 2024 |

| Finalization of Basis of Allotment | 13 May 2024 |

| Initiation of refunds | 14 May 2024 |

| Transfer of shares to demat accounts | 14 May 2024 |

| TBO Tek IPO Listing Date | 15 May 2024 |

| Opening Price on NSE | INR 1,426 per share (up 55%) |

| Closing Price on NSE | INR 1,406.30 per share (up 52.86%) |

TBO Tek IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Ajcon Global –

Arihant Capital – Subscribe

Axis Capital –

Ashika Research –

BP Wealth – Subscribe

Capital Market – May Apply

Canara Bank Securities – Subscribe

Choice Broking –

Dalal & Broacha –

Elara Capital –

Elite Wealth – Apply for long term

GCL Broking –

Geojit –

GEPL Capital – Subscribe

Hem Securities – Subscribe

Hensex Securities –

HDFC Securities –

ICICIdirect –

IDBI Capital –

Investmentz –

Indsec Securities – Subscribe

Jainam Broking – Avoid

KR Choksey –

LKP Research –

Marwadi Financial – Subscribe

Motilal Oswal –

Mehta Equities – Subscribe for listing gain

Nirmal Bang – Subscribe

Reliance Securities –

Sushil Finance – Subscribe for long term

Samco Securities – Not rated

SBI Securities – Subscribe for long term

SMC Global – 2/5

SMIFS – Subscribe

Systematix Research – Subscribe

Swastika Investmart – Apply for long term

Ventura Securities – Subscribe

TBO Tek Offer Lead Manager

AXIS CAPITAL LIMITED

1st Floor, Axis House C-2 Wadia International Center

Pandurang Budhkar Marg, Worli Mumbai – 400 025 Maharashtra

Phone: +91 22 4325 2183

Email: [email protected]

Website: www.axiscapital.co.in

TBO Tek Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Tel: +91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

TBO Tek Contact Details

TBO TEK LIMITED

E-78, South Extension Part I,

New Delhi – 110 049, India

Phone: +91 124 499 8999

Email: [email protected]

Website: www.tbo.com

TBO Tek IPO FAQs

How many shares in TBO Tek IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 75%, NII – 15%, and Retail – 10%.

How to apply for TBO Tek Public Offer?

The best way to apply for TBO Tek public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is TBO Tek IPO GMP today?

TBO Tek IPO GMP today is INR 450 per share.

What is TBO Tek kostak rate today?

TBO Tek kostak rate today is INR NA per application.

What is TBO Tek Subject to Sauda rate today?

TBO Tek Subject to Sauda rate today is INR 2,300 per application.