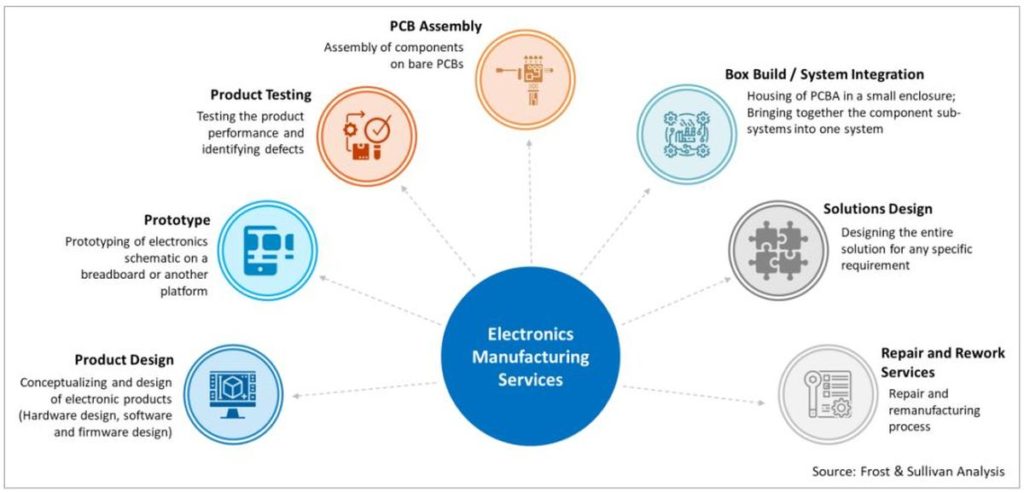

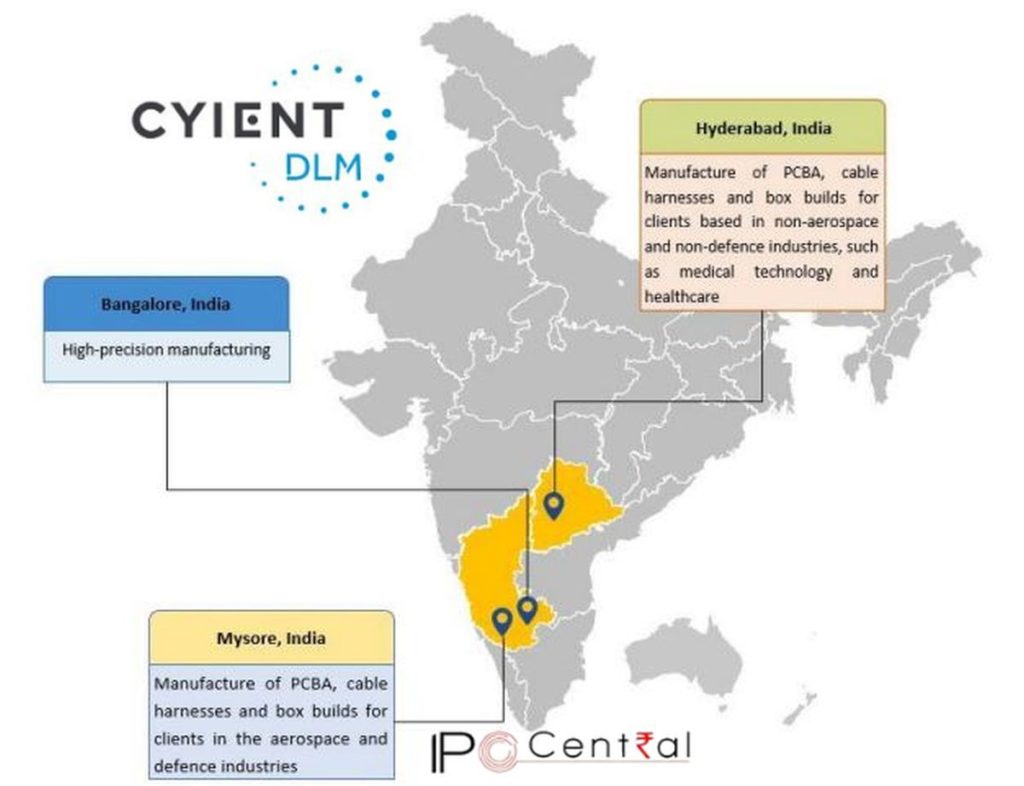

Cyient DLM IPO has opened today for subscription and the Mysuru-based Electronic Manufacturing Services (EMS) player has garnered positive responses from brokerage houses. The company is looking to raise INR 592 crore through the IPO which is priced in the range of INR 250 – 265 apiece. While Cyient DLM IPO broker recommendations are mostly positive and analysts have highlighted its strong capabilities across the value chain, there are some risk factors such as high dependence on certain clients. Here is a snapshot of what broker recommendations are about Cyient DLM IPO.

Cyient DLM IPO Broker Recommendations

Analysts at BP Wealth are positive about the prospects of the EMS players’ IPO. “Post-IPO, the reduction in debt will save financial cost and increase the company’s earnings. We advise cash surplus investors to park funds for long-term rewards. On the upper end of the price band, the issue will be valued at 34.2x FY23 EPS which we believe is fairly priced. We, thus, recommend a “SUBSCRIBE” rating for the issue” said the research house in its recommendation on Cyient DLM IPO. However, the report also highlighted the key risk of high business concentration.

- Top 10 customers of the company accounts for 91.1% of its total revenue.

- The company is heavily dependent on its suppliers and yet it does not enter into definite term agreements with its suppliers.

- It has significant exposure to currency fluctuation as the company earns more than 50% of its revenues from other countries.

Read Also: IdeaForge IPO: All you need to know about India’s top dronemaker

Similar positivity was expressed by Choice Broking in its research note “At higher price band, CDLM is demanding a P/E multiple of 66.2x (to its FY23 earning), which is at premium to the peer average. However, considering the robust order book, strong parentage, and benefits of lower finance costs in the near-to-medium term, we feel the demanded valuation is attractive. Thus we assign a “SUBSCRIBE” rating for the issue”.

Analyst view at Elite Wealth is also positive as its report reads, “Indian electronics industry is expected to grow at a CAGR of 18.4% by FY27 and the company is well-positioned to capitalize on this growth and to achieve its long-term growth goals. Based on FY23 earnings, Cyient DLM is offering the PE of 66x on the upper price band, compared to the industry average of 49.75x. Hence, we suggest investors to “SUBSCRIBE” to the offering.” Exposure to risks such as changes in foreign exchange rates and political instability were also cited as Cyient DLM IPO risk factors.

Nirmal Bang added another positive word in Cyient DLM IPO broker recommendations. “Cyient DLM has strong industry tailwinds working in its favour as the domestic EMS (electronics manufacturing services) industry is expected to grow at 32% CAGR over FY22-27. Over the FY21-23 period, Cyient DLM’s revenue growth is lagging peers at 15% CAGR, however, its strong order book provides decent visibility of accelerated growth going forward. Its valuation on a P/E basis is reasonable compared to peers, at 66.2x FY23 earnings, considering the future growth opportunities,” stated its research note.

Analyst view at GEPL Capital is also positive as its report reads, “Cyeint DLM earnings arrives at INR 31.78 Cr for FY23. At upper price band of INR 265, Company is looking for post issue market cap of INR 2,102 Cr, Which implies a earning multiple (P/E) of 66.14(x). Cyient DLM’s expertise, complex product manufacturing, end-to-end solutions, and customer trust give them a strong competitive edge in the EMS and solution-providing sectors. With well-executed strategies, they are poised to seize promising opportunities driven by industry trends. Hence, We recommend “SUBSCRIBE” rating to the Issue for listing gains.”

Read Also: Cyient DLM IPO: Here is all you need to know

SMC Global offered 3 stars to the public offer while stating the following risk factors:

- The business of the company is dependent on the sale of its products to certain key customers.

- A significant portion of its revenue from operations is derived from its B2P solutions, and from the manufacture and sale of PCBAs.

- All of its manufacturing facilities are located in southern India. Any disruption in any of its manufacturing facilities may adversely affect its business.

- The company is dependent on third-party suppliers for raw materials and components, which are on a purchase-order basis.

In a nutshell, Cyient DLM IPO broker recommendations are mostly positive and while there are risks as outlined above, the consensus view is on the subscription side.