Cyient DLM – the Mysuru-based Electronic Manufacturing Services (EMS) player – plans to raise as much as INR 592 crore through the IPO which is priced in the range of INR 250 – 265 apiece. Here is everything you need to know about Cyient DLM IPO.

#1 Business Overview

Cyient DLM was incorporated in delivering Design Led Manufacturing (DLM) solutions using an integrated manufacturing approach to support the entire product life cycle from concept through manufacturing and certification. The company ensures that products meet very robust standards of reliability, safety, and performance through a methodological approach to improving processes, streamlining the supply chain, and designing value-added solutions thereby helping minimize the total cost of ownership.

Its solutions primarily comprise the manufacture of:

- Printed circuit board (PCB) assembly (PCBA)

- Cable harnesses

- Box builds which are used in safety-critical systems such as cockpits, inflight systems, landing systems, and medical diagnostic equipment, which we provide to our clients as B2P or B2S services.

Read Also: Cyient DLM IPO gets positive broker recommendations

#2 Client Base

Cyient’s customers belong to a diverse range of high-entry-barrier industries that have stringent quality and qualification requirements. It enjoys long-term relationships as an integrated partner to multiple marquee customers such as Honeywell International, Thales Global Services, and Bharat Electronics, among others.

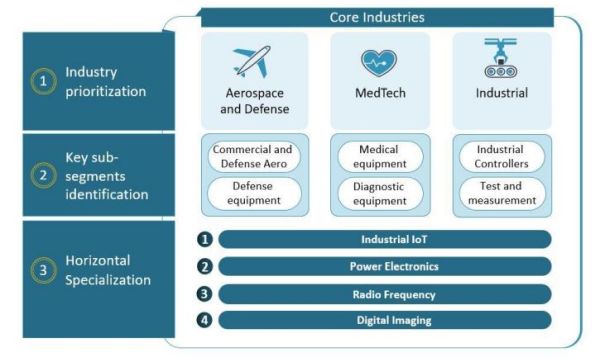

#3 Core Industries

The company counts Aerospace & Defense, Medical Technology, and Industrial among its key industries. Within these industries, Cyient DLM’s expertise is in Defense equipment, Medical and diagnostic equipment, Industrial controllers, and test and measurement tools.

#4 Valuations and Margins

| BASIS | FY 2021 | FY 2022 | FY 2023 |

| EPS (INR) [Earning per share] | 4.30 | 16.17 | 7.75 |

| RoNW (%) [Return on Net Worth] | 31.38 | 51.61 | 16.03 |

| NAV (Net Asset Value) | – | – | 48.33 |

| Revenue growth (%) YoY | 37.40 | 14.73 | 15.47 |

| Gross Profit (INR) in crores | 79.03 | 113.03 | 129.39 |

| Gross Profit margin (%) | 12.58 | 15.69 | 15.55 |

| EBITDA (INR) in crores [Earnings before interest, tax, depreciation, and amortization] | 45.94 | 84.04 | 87.78 |

| ROCE (%) [Return on capital employed] | 11.48 | 17.56 | 13.48 |

#5 OBJECTS OF THE ISSUE

Cyient DLM proposes to utilize the Net Proceeds towards funding the following objects:

- Funding incremental working capital requirements

- Funding capital expenditure

- Repayment/prepayment, in part or full, of certain borrowings

- Achieving inorganic growth through acquisitions

- General corporate purposes

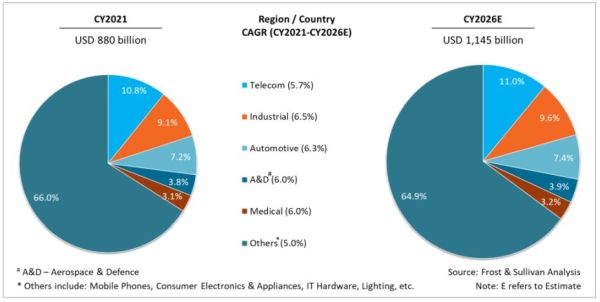

#6 EMS market segmentation by end-user industries

Aerospace and Defence (A&D) is a relatively small but key revenue-contributing segment. OEMs perceive EMS providers as strategic solution partners, as it gives them an average savings of 10% to 15%. The outlook for the aerospace and defense industry is optimistic. In the next few years, apart from cost, A&D OEMs will consider EMS providers’ expertise in advanced technologies as a key partnership factor in boosting EMS revenue.

Key trends that will drive new opportunity in this sector include digital thread and smart factory driving efficiencies, defense contracts building advanced military capabilities (like the ongoing US government support for the National Defence Strategy will likely keep defense spending stable), growth in the space in key areas like the launch industry, satellite trends, etc.

Read Also: IdeaForge IPO: All you need to know about India’s top dronemaker

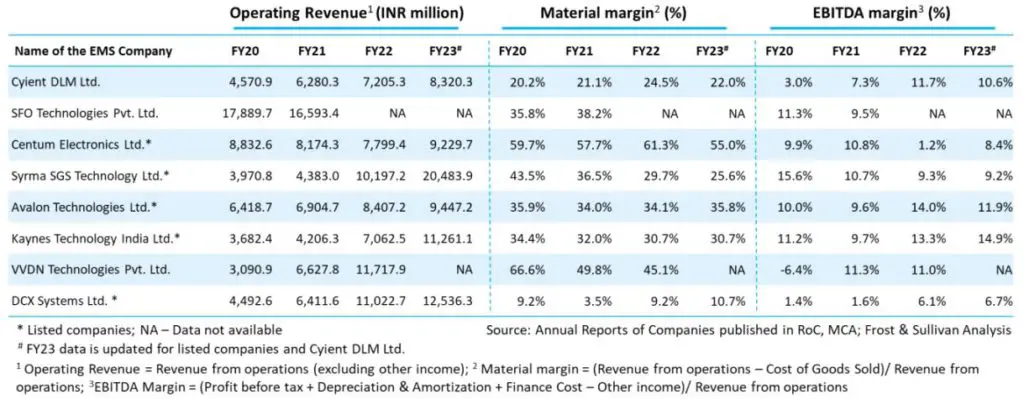

#7 Financial benchmarking of key EMS players

#8 Strategies to strengthen the competitive position

The company wants to focus on specific industries and improve its abilities in those areas. It will do this by strengthening and expanding its relationships with current clients and by acquiring new clients in those industries. Cyient DLM believes that the increasing demand for products within the country and the trend of outsourcing will encourage domestic electronics manufacturers to produce more components locally, which will make the industry stronger.

The company also believes that it is well-positioned to take advantage of global players looking to set up manufacturing facilities in India.

Cyient DLM plans to benefit from the increasing use of technologies like artificial intelligence and machine learning, as well as the growing electronification of products. It also wants to expand its order book by undertaking strategic projects and opportunities along the product value chain.

Additionally, the company wants to increase its profitability by gaining a larger market share in complex industries and taking on more Business-to-Services (B2S) contracts.