Indegene, a digital-led commercialization services provider to the life sciences sector, is planning to float its IPO next week. What it means is that investors interested in life sciences and healthcare technology exposure have an opportunity to invest in a company that has extensive knowledge in the field and provides technology-enabled solutions. The following are 10 things you should know about the Indegene IPO and why it stands out:

Table of Contents

#1 Indegene IPO: Focus on Life Sciences Commercialization

Indegene specializes in providing digital-led commercialization services to the life sciences industry, including biopharmaceutical, emerging biotech, and medical devices companies. Its comprehensive offerings range from assisting with drug development and clinical trials to regulatory submissions, pharmacovigilance, sales, and marketing of products. The following is a description of its solutions:

- Enterprise Commercial Solutions: Indegene’s services to life sciences companies with digital marketing operations and customer data management, including marketing plans and campaigns that are customized. The sales and marketing segment of life sciences operations spending in 2022 was its largest segment.

- Omnichannel Activation: Indegene’s solutions to life sciences companies, last-mile promotion of biopharma products and medical devices to health care professionals (HCPs) through multiple channels.

- Enterprise Medical Solutions: Geographically distributed headquarters support reputation and brand management regulatory and medical operations, including huge medical content, creation, regulatory submissions, pharmacovigilance, and real-world evidence (RWE).

- Enterprise Clinical Solutions and Consultancy Services: Indegene’s life sciences operations solutions aim to drive efficiencies in drug discovery and clinical operations for life sciences clients, focusing on patient recruitment, data management, and regulatory submissions. The company operates a small consultancy business through its subsidiary DT Associates Limited. It operates the ‘DT Consulting’ brand to provide consultancy. Indegene assists customers in gaining control of their digital transformation processes to ensure that they are successful in customer experience.

#2 Indegene IPO: Market Growth Potential, and Geographic Reach

According to market research estimates, Global life sciences operations expenditure reached INR 12.0 trillion (USD 156 billion) in 2022 and is projected to grow at a CAGR of 6.5% to INR 15.5 trillion (USD 201 billion) by 2026. Indegene’s focus on this expanding market offers investors potential for growth.

The company functions from 6 operation hubs and 17 offices located in North America, Europe, and Asia to cater to the needs of the client base with a global approach.

Read Also: Best Foreign MNC Stocks Listed in India

#3 Indegene IPO: Strong Client Base

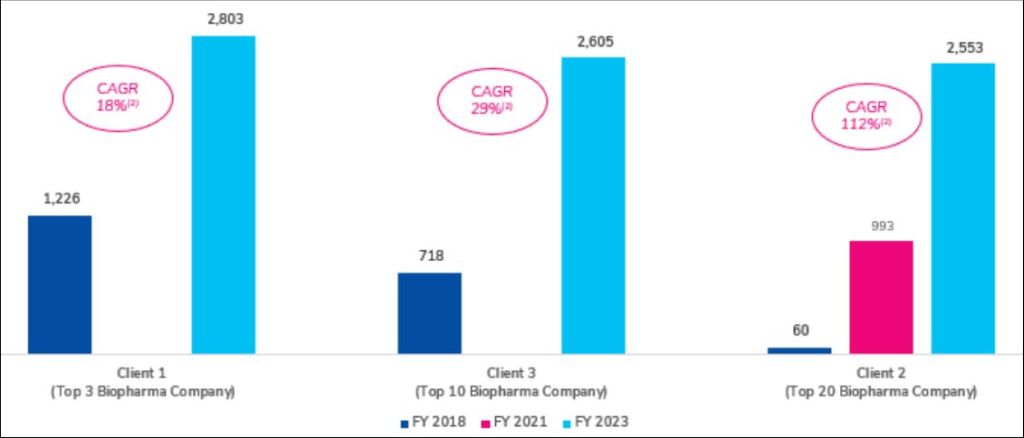

The company has relationships with each of the 20 largest biopharmaceutical companies globally by revenue for FY 2023. Indegene serves a total of 65 active clients, including emerging biotech and medical device companies, generating over 69% of its total revenue from operations in the last few years. It had 27 clients from whom it earned between USD 1 million and USD 10 million in revenues, five clients from whom it earned between USD 10 million and USD 25 million in revenues, and three clients from whom it earned more than USD 25 million in revenues, during the 12 months ended 31 December 2023.

Read Also: Best IPOs that Doubled Investors’ Money

Represents the compound annual growth rate for the relevant data between the Financial Years 2018 and 2023.

#4 Indegene IPO: Growth Potential in Outsourcing

The outsourcing penetration rate in life sciences sales and marketing remains low (7-12%), but this segment is expected to grow at a CAGR of approximately 14.5% between 2022 and 2026. Indegene is well-positioned to capture this market.

#5 Indegene IPO: Offer Details

The Indegene IPO is scheduled for 6 to 8 May 2024. The public issue consists of an Offer for Sale (OFS) of 23,932,732 shares and a Fresh Issue amounting to INR 760 crores. The retail investors are allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

Read Also: Tata Sons IPO: Here is Why a Listing is Not Desirable

#6 Indegene: Objects of the Issue

The company proposes to utilize the Net Proceeds from the Fresh Issue towards funding the following objects:

- Repayment/prepayment of indebtedness of a subsidiary, ILSL Holdings – INR 391.34 crore

- Funding the capital expenditure requirements of the company and its subsidiary, Indegene, Inc. – INR 102.92 crore

- General corporate purposes

#7 Indegene: Robust Digital Capabilities

Indegene has built the entire suite of proprietary tools and platforms, which includes a set of applications that automate and bring AI-based efficiencies using AI, ML, NLP, and leading-edge analytics capabilities. Indegene’s proprietary ‘NEXT’-branded tools and platforms help drive transformation along the commercialization lifecycle for biopharmaceutical and medical device products.

#8 Indegene IPO: Impressive Financial Performance & Margins

Indegene generates revenue from different sources, the main being enterprise commercial solutions and enterprise medical solutions. During FY 2023, the company made USD 13,568.89 million, equal to 58.84% of revenue, and USD 5,602.27 million, equal to 24.29% through enterprise commercial solutions and enterprise medical solutions respectively.

Similarly, the growth in profits has also been impressive, and margins are improving after suffering a decline in FY 2022.

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | 966.27 | 1,664.61 | 2,306.13 | 1,916.61 |

| Expenses | 768.25 | 1,417.10 | 2,001.05 | 1,644.64 |

| Net income | 149.41 | 162.82 | 266.10 | 241.90 |

| Margin (%) | 15.46 | 9.78 | 11.54 | 12.62 |

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 7.01 | 7.46 | 11.97 |

| PE ratio | – | – | – |

| RONW (%) | 46.04 | 21.57 | 25.02 |

| NAV | 16.42 | 34.80 | 48.10 |

| Adjusted EBITDA (%) | 27.03 | 18.79 | 19.69 |

Read Also: Top Bootstrapped Companies in India

#9 Indegene IPO: Employees

Indegene had 4,461 employees in India as of 31 December 2023. Additionally, the company employed 530 in North America, 105 in Europe, 73 in China, and 12 in other regions. Furthermore, the company continues to recruit employees internationally following its expansion in new markets.

Out of its total headcount, the company had 4,510 employees working in delivery units. These employees did not belong to corporate and support functions and were instead focused on the core functions. The company also reported as of 31 December 2023, 20.49% of its delivery unit employees had healthcare credentials such as MD, MBBS, PhD, BDS, MPharm and BPharm degrees.

Read Also: Biggest IPOs of 2024

#10 Indegene IPO: Risk Factors

- Its business is exclusively devoted to the life sciences industry and may be adversely affected by factors that affect the life sciences industry, including the expansion or consolidation of the total life sciences market, the rise of outsourcing, and other trends.

- A substantial percentage of its business comes from unique large customers based in North America and Europe.

- Indegene is also regulated by data protection and various other laws.

- Most of the revenues are through the subsidiaries. Disruption in the operation of one or several of the subsidiaries may harm its business, financial position, and outcomes of operation.

- Moreover, Indegene’s clients are significantly pressured by competition from more affordable generic alternatives and other similar products, which may decline the sum that they spend on its solutions and harm the business, operations performance, cash flows, and financial position.

- Finally, much of its operations are done through independent sub-contractors and third-party service providers, who might fail to perform their contractual obligations satisfactorily.