Mumbai-based Glenmark Life Sciences plans to launch its IPO on 27 July for subscription. The company is a developer and manufacturer of select high value, non-commoditized active pharmaceutical ingredients (APIs). Here are 10 key things you need to know before investing in Glenmark Life IPO.

#1 Offer Structure

Like most public offers this season, Glenmark Life IPO will involve issuance of new shares as well as a sale by existing shareholders. The company aims to raise INR1,060 crore by issuing fresh shares.

In addition, 63,00,000 shares will be sold by its promoter Glenmark Pharmaceuticals.

#2 Offer Pricing

Glenmark Life Sciences has filed its Red Herring Prospectus (RHP) and has revealed offer pricing in the range of INR695 – 720 per share.

#3 Lot Size and Category-wise Reservation

Since the company is yet to announce pricing of the offer, lot size is also not known at the moment.

Nevertheless, there is a reason to be happy for retail investors as the offer RHP mentions 35% of shares will be reserved for small investors. Retail portion was indicated to be only 10% in DRHP so clearly, better allotment chances for retailers now. 15% of the offer is reserved for NIIs (Non-Institutional Investors) and 50% for QIBs (Qualified Institutional Buyers).

#4 Major Shareholders

Glenmark Life Sciences is currently fully owned by its promoter Glenmark Pharmaceuticals. Nevertheless, this is scheduled to change after the IPO as Glenmark Life Sciences plans to make payment towards buying out Glenmark Pharmaceuticals’ stake.

#5 Glenmark Life IPO – Objects of the Offer

Out of the IPO proceeds of INR1,060 crore by issuing new shares, the company aims to use the majority towards:

- Payment of outstanding purchase consideration to Glenmark Pharmaceuticals for the spin-off of the API business – INR800 crore

- Funding capital expenditure requirements – INR152.8 crore

- General corporate purposes

Through a Business Purchase Agreement dated 9 October 2018, Glenmark Pharmaceuticals agreed to transfer its API business to Glenmark Life Sciences through a slump sale for a consideration of INR1,162.2 crore. Out of this, Glenmark Life Sciences has already paid INR350.3 crore and the remaining amount is proposed to be paid after IPO.

#6 Business Overview

Glenmark Life Sciences is an API manufacturer with a focus on high value, non-commoditized active pharmaceutical ingredients. These APIs are used in chronic therapeutic areas, such as cardiovascular disease (CVS), central nervous system disease (CNS), pain management and diabetes, gastro-intestinal disorders, anti-infectives and other therapeutic areas. Some of the APIs where the company has strong market share are Telmisartan (anti-hypertensive), Atovaquone (anti-parasitic), Perindopril (anti-hypertensive), Teneligliptin (diabetes), Zonisamide (CNS) and Adapalene (dermatology).

In addition API manufacturing, the company provides contract development and manufacturing operations (CDMO) services to several multinational and specialty pharmaceutical companies. CDMO contributes nearly 13% to the company’s top-line and is a higher-margin business when compared with API manufacturing.

As of 31 March 2021, Glenmark Life Sciences had a portfolio of 120 molecules globally and sold its APIs in India and exported to multiple countries in Europe, North America, Latin America, Japan and the rest of the world (ROW). As of 31 May 2021, it had filed 403 Drug Master Files (DMFs) and Certificates of suitability to the monographs of the European Pharmacopoeia (CEPs) across various major markets. As of 31 March 2021, 16 of the 20 largest generic companies globally were its customers.

#7 Manufacturing Infrastructure

The company has four multi-purpose manufacturing facilities located at Ankleshwar and Dahej (both in Gujarat) and Mohol and Kurkumbh (both in Maharashtra) with an aggregate annual total installed capacity of 726.6 KL as of 31 March 2021.

Going forward, the company plans to increase its API manufacturing capabilities by enhancing the existing production capacities at Ankleshwar facility during FY2022 and Dahej facility during FY2022 and FY2023 by an aggregate annual total installed capacity of 200 KL.

In addition, it intends to develop a new manufacturing facility in India for the production of generic APIs from the FY2022 which is expected to become operational in the fourth quarter of FY2023. The new facility will also provide a platform for the growth of CDMO business and also add capacity for generic API business.

#8 Financial Performance

The company’s financial performance in recent years has been on a strong footing with revenues rising consistently, even during last year amid Covid-19 pandemic. Similarly, Glenmark Life Sciences’ profits have grown in each of the last 3 years. Margins have also been stable in these years.

| FY2018 | FY2019 | FY2020 | FY2021 | |

| Revenue | 1,202.2 | 1,405.5 | 1,549.3 | 1,886.0 |

| Expenses | 892.8 | 1,001.7 | 1,128.2 | 1,415.0 |

| Net income | 229.5 | 293.1 | 313.6 | 351.1 |

| Margin (%) | 19.1 | 20.9 | 20.2 | 18.6 |

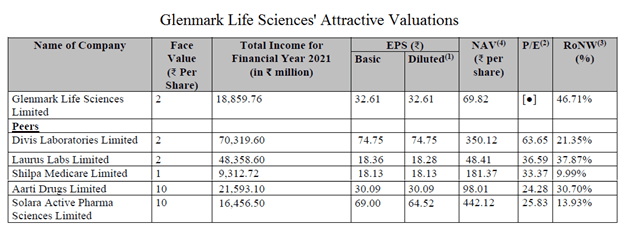

#9 Valuations and Peer Comparison

At the price band of INR695 – 720 per share, it is asking a PE ratio range of 21.3 – 22.1. This is quite reasonable considering most of its competitors trade at higher valuations. Glenmark Life Sciences’ valuations are also more attractive when its superior return ratios are taken into consideration. For example, its RONW at 46.7% is higher than its peers.

#10 Glenmark Life IPO – Strong Grey Market Demand

Glenmark Life Sciences has also started trading at a premium in the informal or grey market and considering its strong fundamentals, it is not surprising. As on the date of this article, Glenmark Life IPO is commanding a premium of INR250 per share, translating to roughly 35% over offer price.

While grey market has been quite accurate in predicting listing gains, it is to be noted that situations may change pretty quickly in informal market. We don’t trade or facilitate trades in grey market.