As Awfis Space Solutions prepares for its initial public offering (IPO), investors have a unique opportunity to delve into the inner workings of India’s largest flexible workspace solutions provider. Here’s a comprehensive look at Awfis Space Solutions IPO, highlighting its market position, business model, growth strategy, and financial performance.

Table of Contents

#1 Awfis Space Solutions IPO: Market Leadership with 169 Centers

As of 31 December 2023, Awfis Space Solutions holds the top position in India’s flexible workspace market based on the total number of centers. According to the CBRE Report, Awfis leads with 169 centers across 16 cities, offering a total of 105,258 seats and a chargeable area of 5.33 million sq. ft. Awfis has established its presence in 52 micro-markets across India, more than any other flexible workspace provider. This extensive network ensures a strategic advantage in meeting the diverse needs of clients from various locations.

#2 Awfis Space Solutions IPO: Diverse Offerings and Integrated Solutions

Awfis offers a wide range of workspace solutions to meet various needs—from individual flexible desks to customized office spaces for startups, SMEs, large corporates, and multinational corporations. The company’s offerings include co-working spaces, flexible workspaces, and tailored office spaces. Additionally, Awfis has developed ancillary services such as Awfis Transform (construction and fit-out services) and Awfis Care (facility management services), enhancing its appeal as a comprehensive integrated workspace solutions provider.

Read Also: Best Foreign MNC Stocks Listed in India

#3 Awfis Space Solutions IPO: Evolution and Strategic Shifts

Launched in 2015, Awfis initially focused on co-working spaces, targeting companies seeking high-quality infrastructure at affordable rates. Over time, the company adopted an asset-light model, transitioning from the traditional straight lease (SL) model to a managed aggregation (MA) model. This strategic shift reduced capital expenditure risks and aligned the company’s interests with property owners through profit-sharing and minimum guarantee arrangements. During FY 2023, Awfis shared 8.99% of its revenue from contract with customers.

Since the MA model works better for the company, Awfis has increased the percentage of operational seats under the model from 46.37% in FY 2021 to 57.66% in FY 2023. Including seats under fit-out, this figure increased to 66.43% as of December 31, 2023.

Read Also: Best IPOs that Doubled Investors’ Money

#4 Awfis Space Solutions IPO: Market Trends and Growth Potential

The Indian office market is expected to grow at a CAGR of 6.3% from 2023 to 2026. Flexible workspaces have experienced substantial growth, with the market size tripling over the past few years. As of 31 December 2023, the flexible workspace segment in Tier 1 cities reached about 62 million sq. ft., and 5.7 million sq. ft. in Tier 2 cities. Awfis has been proactive in leveraging this trend by expanding its presence in Tier 2 cities, where demand for flexible workspaces is anticipated to rise significantly in the next 3-4 years.

#5 Awfis Space Solutions IPO: Offer Details

The Awfis Space Solutions IPO is scheduled for 22 to 27 May 2024 and is priced in the range of INR 364 – 383 per share. The public issue consists of an Offer for Sale (OFS) of 1,22,95,699 shares and a Fresh Issue amounting to INR 128 crores. Retail investors will be allotted 10% of the shares. The IPO will be listed on both BSE and NSE.

#6 Awfis Space Solutions IPO Objectives

The company proposes to utilize the Net Proceeds towards funding the following objects:

- Capital expenditure towards establishment of new centers – INR 42.03 crore

- Working capital requirements – INR 54.37 crore

- General corporate purposes

#7 Awfis Space IPO: Client Base and Retention Strategy

As of December 2023, Awfis boasts a diverse client base of over 2,295 clients. The company has seen a significant increase in demand from large corporates and multinational corporations, leading to the launch of ‘Awfis Gold,’ a premium offering in Grade A buildings. Awfis has established strong relationships with various space owners, ranging from large developers to high-net-worth individuals. Prominent space owners include Prestige Estate Projects, Nyati Projects Landmark, and Majestic Auto Limited. This diverse portfolio has resulted in a high renewal rate for space owner agreements, at 93.33% in FY 2023.

The company’s renewal strategies, such as the ‘Expiry 90’ tool, help forecast and manage client renewals efficiently. The company’s average monthly net churn rate dipped from 5.14% FY 2021 to 1.60% in FY 2022 and further to 1.34% in FY 2023.

Read Also: Tata Sons IPO: Here is Why a Listing is Not Desirable

#8 Awfis Space Solutions IPO: Improving Financial Performance

From FY 2021 to 2023, Awfis’ revenue grew at a CAGR of 74.85%, rising from INR 178.36 crore to INR 545.28 crore. Although the company is yet to become profitable on net income basis, it is profitable on cash EBIT basis. Awfis’ cash EBIT grew by 125.41% during this period, reflecting improving financial health and operational efficiency.

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | 178.36 | 257.05 | 545.28 | 616.50 |

| Expenses | 258.66 | 335.87 | 612.42 | 652.64 |

| Net income | (42.64) | (57.16) | (46.64) | (18.94) |

| Margin (%) | (23.91) | (22.24) | (8.55) | (3.07) |

Read Also: Top Bootstrapped Companies in India

| FY 2021 | FY 2022 | FY 2023 | |

| RONW (%) | (28.29) | (60.34) | (27.54) |

| NAV | 22.81 | 14.33 | 25.62 |

| ROCE (%) | 10.88 | 1.75 | 25.26 |

| EBITDA (%) | 42.01 | 32.29 | 31.12 |

| Debt/Equity | 0.02 | 0.13 | 0.06 |

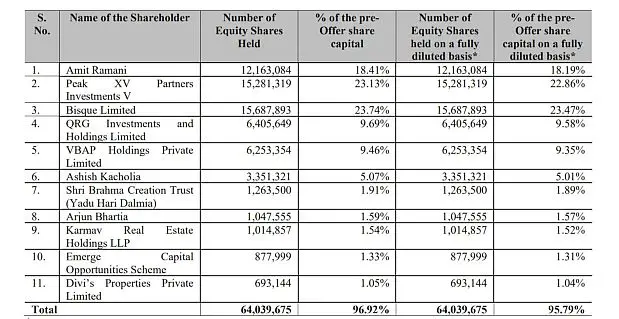

#9 Awfis Space IPO: Ashish Kacholia Among Investors

Awfis Space operates in an interesting space which is likely to witness better demand in the coming years and this is validated by the number of external investors onboard. With a shareholding of 22.86% on fully-diluted basis, Peak XV is among the promoters of the company.

Other prominent investors include Bisque Limited, Link Investment Trust

(Chrys Capital Group), QRG Investments and Holdings Limited, VBAP Holdings Private Limited and Shri Brahma Creation Trust, Karmav Real Estate Holdings LLP (Arun Bharat Ram Group) and celebrated investor Ashish Kacholia.

Read Also: Biggest IPOs of 2024

#10 Awfis Space Solutions IPO: Strong Project and Operations Management

The company has a team of 63 designers and project managers which covers a broad spectrum of tasks including site feasibility, design, construction and facility management.

Awfis’ operations department is made up of 184 employees as of December 31, 2023. This includes over 100 employees with a background in hospitality. The operations department plays a vital role in maintaining robust standard of service, operational excellence, and cost efficiency, and is comprised of two separate teams i.e. Front of the House and Back of the House.

The Path Ahead

Awfis is in a sweet spot to take advantage of the increasing demand for flexible workspaces in India. With its expansive network, varied offerings, and targeted expansion into Tier 2 cities, the company is set for long-term growth. As the market continues to evolve in the aftermath of the pandemic, Awfis’ comprehensive solutions and customer-focused approach are expected to fuel ongoing success.

For investors, Awfis Space Solutions represents a compelling opportunity to invest in a market leader within a rapidly growing industry. While the company continues to work towards profitability, the presence of several prominent investors is another positive factor. It also helps that the upcoming IPO commands a healthy premium in the grey market.