Last updated on June 24, 2024

Kshitij Polyline Rights Issue is scheduled for 25 June – 9 July 2024

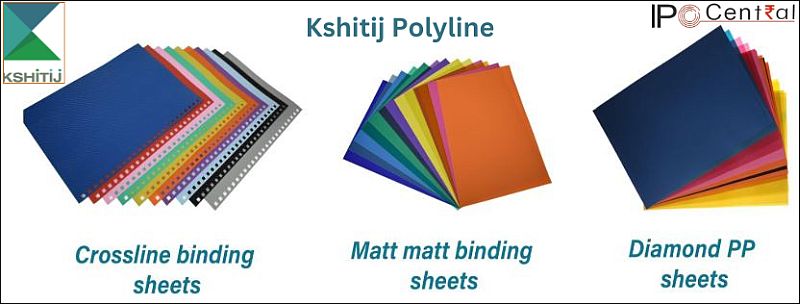

Kshitij Polyline and its executives have honed their skills in designing and innovating office stationery, calendars, diaries, and student study materials in various colors, designs, and applications. The company has also assembled an in-house technical and design team to offer stationery solutions and implement new and innovative PP materials for calendars, diaries, and books, replacing traditional materials.

The company has successfully launched a wide product range, established goodwill for quality products, and has regular clients for laminated & PP sheets, Wiro, files, and folders. The company has developed and launched more than 125 product ranges in File, Folder & Diary under its brand in Indian Market. Their diverse product range caters to various consumer preferences and segments, primarily serving clients in the education, healthcare, hospitality, banking, insurance, and IT sectors.

Promoters of Kshitij Polyline –: Bharat Hemraj Gala, Hemraj Bhimshi Gala, and Rita Bharat Gala

Table of Contents

Kshitij Polyline Rights Issue Details

| Kshitij Polyline Rights Issue Date | 25 Jun – 9 Jul 2024 |

| Kshitij Polyline Rights Issue Price | INR 6.40 per share |

| Issue Size (in Shares) | 4,05,21,875 shares |

| Issue Size (in INR) | INR 25.93 crore |

| Issue Entitlement | 4 equity shares for every 5 equity shares held on the record date |

| Terms of Payment | Rights Issue of fully paid-up Equity shares |

| Kshitij Polyline Rights Issue Record Date | 18 June 2024 |

| Face Value | INR 2 per share |

| Listing On | NSE |

Kshitij Polyline Rights Issue Calculation

| Rights Issue Price | INR 6.40 per share |

| Market Price on Rights Issue Approval | INR 7.03 per share |

| Dilution Factor (X) | 1.8 |

| Fair Value After Dilution at Prevailing Price | INR 6.75 per share |

Kshitij Polyline Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 39.04 | 33.86 | 59.40 |

| Expenses | 35.28 | 30.56 | 60.49 |

| Operating Margin (%) | 9.36 | 9.75 | (1.84) |

| Net income | 0.42 | 0.45 | 1.61 |

| ROCE (%) | – | 6.09 | – |

Kshitij Polyline Rights Offer Objectives

The company intends to utilize the Net Proceeds from the Issue to augment the capital base of the company.

- To repay or prepay, in full or in part, certain borrowings availed by the company (including interest) – INR 13.20 crores

- Capital expenditure for the purchase of plant and machinery – INR 6.49 crores

- General corporate purposes

Kshitij Polyline Rights Offer Documents

- Kshitij Polyline Rights Issue Application Form

- Kshitij Polyline Letter of Offer

- Board Meeting Outcome

- Rights Issue in 2024

Kshitij Polyline Rights Issue Dates

| Rights Issue Approval Date | 13 June 2024 |

| Rights Issue Record Date | 18 June 2024 |

| Credit of Rights Entitlement | 20 June 2024 |

| Rights Issue Opening Date | 25 June 2024 |

| Last Date for Market Renunciation | 3 July 2024 |

| Rights Issue Closing Date | 9 July 2024 |

| Finalization of Basis of Allotment | 15 July 2024 |

| Kshitij Polyline Rights Allotment Date | 16 July 2024 |

| Credit Date | 18 July 2024 |

| Listing Date | 22 July 2024 |

Kshitij Polyline Rights Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Tel: +91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

Kshitij Polyline Contact Details

KSHITIJ POLYLINE LIMITED

417/418, Dimple Arcade, Near Sai Dham temple,

Thakur Complex, Kandivali (East), Mumbai – 400101

Phone: +91 22 4223 4100

Email: [email protected]

Website: www.kshitijpolyline.co.in

Kshitij Polyline Rights Offer FAQs

What is the Kshitij Polyline Rights Issue Price?

The issue price is INR 6.40 per share.

What is the Kshitij Polyline Rights Issue entitlement ratio?

The eligible shareholders are offered 4 Equity Shares for every 5 Equity Shares held on the record date.

What is the Kshitij Polyline Rights Issue Record Date?

The Record date is 18 June 2024.

How to Apply for Kshitij Polyline Rights Offer?

The best way to apply for Kshitij Polyline Rights Offer is through Internet banking ASBA. You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an application Form form and deposit the same to your broker.